Expert Commission on Energy Regulation: main report

The final report of the Expert Commission on Energy Regulation, including the Commission's conclusions and key messages.

Options For an Optimal Policy and Regulatory Environment To Encourage Renewable Generation, Including Incentives For Innovative Generation and Network Technologies and the Supply Chain

- Scotland's longstanding commitment to renewable generation and emissions reduction targets have provided a consistent signal to encourage investors

- The ability to trade and export Scottish renewable power across UK and European markets will be crucial to delivering Scotland's renewable aspirations

- Continuity of existing support mechanisms will reassure investors

- Any support will need to remain consistent with developing European targets and policy, including the role of competitive forces to reduce and determine technology costs

- The Scottish Government could tailor existing or new mechanisms to better reflect priorities and circumstances, subject to addressing the costs and potential complexities involved for generation, networks and consumers

- The Commission supports the joint efforts being undertaken by the Scottish and UK Governments to encourage the development of the energy resources of the Scottish Islands

- The Scottish Government could develop a wider range of tools which could be used to provide financial and structural support for technology, infrastructure and supply chain development

- Renewable generation requires connection and transmission capacity to reach its point of use

- Continuing development of the transmission and distribution networks will be important, including smart grid innovation technologies

The renewables industry has made significant investments, both in Scotland and across the UK, in response to the incentives and obligations put in place by both Governments, and the need to deliver economically efficient generating capacity.

EU targets for 20% of energy supplies (heat, transport and electricity) to be provided from renewable sources by 2020 are binding on Member States and the UK still has much to do. Future proposals set out by the EU as part of their 2030 climate and energy package have not been finalised, but provide greater flexibility for Member States to contribute to an overall EU target likely to be 27% of energy supplies. Investment in renewable energy supplies will take place where it is economically efficient to do so.

The prolific growth of renewables across Scotland in particular over the past decade reflects the huge natural resource that exists and the consistent commitment shown by the Scottish Government to support ambitious renewable energy targets. It has also taken place against the backdrop of a UK market for renewable electricity with the Scottish Government autonomy to set the same, or different levels of support, where warranted [50] .

Given existing policy commitments there will still be a strong demand for renewable power in the event of independence - both across the UK and potentially Europe, where the energy will be needed, subject to the required connections, network capacity and investments being equitably apportioned. Future renewable development requires an increase in grid access and capacity as well as interconnection to provide a route to market. The EU Commission's ambitious plans for expansion of trans-European networks to provide energy security within the union will be particularly relevant to Scotland. This demand will extend from onshore wind, which is proven, and on a path towards grid parity with non-renewable alternatives to offshore technologies, where Scotland has unique potential.

The Scottish Government should continue to prioritise the development of a supply chain and support for the development of offshore renewable technologies in deeper waters, where innovation and cost reduction could have real significance for global export markets. There is greater opportunity for Scotland to benefit from EU support for renewable expansion while aligning with guidance on minimising market distortion.

Serious efforts to encourage the development of gas storage is necessary for security of supply. To achieve objectives in a reliable, robust low carbon electricity supply, energy storage and smarter network management must be introduced. Scotland can access international markets and meet growing domestic needs and demands by aligning itself with Energy and Climate initiatives at the European Union level. Technology and industrial policy will be crucial enablers in all of this.

The Commission considers that there is a need to look at the implications on system security of the shifting balance between renewable and thermal electricity generating capacity as Scotland's existing power stations are retired, taken in the context of whole system operability and environmental objectives.

Delivery of Scotland's Renewable Ambitions

Scotland's very ambitious renewable energy targets, and determination to support the development of emerging technologies and foster community renewable ownership and benefit, are well understood by the industry and investors. There is considerable scope for further community scale renewable development where the combination of manageable size of project, community involvement and benefit improve the local acceptability of schemes.

Continuity of Market Mechanisms

Successive Scottish Governments have strongly promoted the outstanding renewable resource which exists across Scotland's land and seas - amounting to around a quarter of Europe's wind and tidal potential, and a tenth of the Continent's wave energy resource - and the role that these resources could play in driving sustainable growth, enhancing the diversity and security of Scotland's energy supplies, and transforming and empowering the lives of those in rural and remote communities.

The key to achieving this through the years has been the Renewables Obligation ( RO) mechanism. Scotland has had its own RO since 2002 when the legislation was first introduced, working alongside similar ROs applying in England & Wales, and - from 2005 - Northern Ireland.

The RO in Scotland is created using powers devolved from the 1989 Electricity Act. The three UK ROs are near identical, and combine to create a UK-wide market for the Renewable Obligation Certificates ( ROCs) awarded to eligible renewable generators. However, Scottish ministers have, through the years - and subject to the approval of both the Scottish Parliament and the European Commission - taken a slightly different approach in order to provide appropriate levels of support for technologies seen as having particular strategic importance to Scotland.

The most notable example of this concerns wave and tidal power. An obligation upon suppliers to buy a specified amount of wave and tidal power at a higher rate than other renewable technologies was introduced in 2007. When the ability to award different multiples of ROC to different forms of renewable generation (known as technology 'bands') was introduced across the UK in 2009, the Scottish Government used its powers to set higher bands for wave and tidal generators in Scottish waters than were available at any other location across the UK.

This difference has now been removed following the raising of wave and tidal bands in Northern Ireland, England and Wales to the levels which applied in Scotland. However, the Scottish Government has recently held its hydro band at the same level following reductions to that band elsewhere in the UK, and has also introduced new bands for innovative offshore wind generation which are available in Scotland only.

It is also worth noting that the RO in Northern Ireland has taken different approaches to particular technologies (such as anaerobic digestion and solar PV) when considered necessary.

These examples are interesting in that they provide evidence of a joint market and system continuing to work efficiently despite variations in approach amongst its separate component parts. They demonstrate that a single market can and should be capable of weathering such differences in approach where those differences are held to be necessary - and where an agreement has been established as to their extent, cost and incorporation.

An independent Scotland's ability to maintain course toward the renewable targets and aspirations set by the current Scottish Government will hinge on clarity as early as possible regarding continuity of current and proposed market mechanisms, and access for Scottish generation to those mechanisms. Subject to State Aid approvals, the adoption of the Contract for Difference (CfD) structure in a jointly regulated single market could provide the required continuity and consistency for industry and investors.

This experience demonstrates that Scotland and the rest of the UK can operate a market mechanism which accommodates minor differences across jurisdictions. Having autonomy over the review and setting of technology support levels under the RO (Scotland) has required a consideration of, and accountability for the cost impacts on consumers. It has also provided a clearly defined process by which economically efficient generation can be developed in one jurisdiction in order to provide benefits to consumers in another. This holds true for technology subsidy where there are limited impacts, but cannot be considered as a remedy in all cases.

Similar experience can be found in the common Swedish and Norwegian certificate market for renewable electricity [51] . The certificate scheme was introduced in Sweden in 2003 and became a common certificate scheme with its adoption by Norway from January 2012. The rationale behind the operation of a joint support scheme was that it would provide improved market functioning e.g. higher liquidity, better price formation and also a bigger market more attractive for investors. This would also bring increased cost-efficiency, access to larger production base and increased long-term predictability for investors through a politically stable system. Underlying the success of the common certificate market was the understanding by Sweden and Norway that the market was not required physically to deliver equal levels of capacity in each country. The common certificate scheme brought forward the most economically efficient renewable generation capacity to the market.

The Commission believes that the ability to agree and operate such differences will remain an important element of Scotland's policy options post-independence. Experience suggests that degrees of difference are not impossible to achieve and administer.

The Commission assumes that Scotland will remain with rGB within the EMR framework. A post-independent Scottish Government could, over time, tailor new and additional mechanisms to promote renewable expansion. These could prioritise areas which present a strategic opportunity, or a natural or competitive advantage for Scotland.

However, there are likely to be natural limits to this, as well as questions regarding the costs of such differences and how those costs are to be met. These are questions which a robust agreement and strategic energy partnership between Scottish and rUK Governments will need to define.

There will also be separate avenues that an independent Scottish Government could explore, over and above the operation of a UK-wide market mechanism. New financial and borrowing powers conferred by independence could enable fresh approaches to be taken to promote innovation and help reduce the technology cost and risk of new renewable projects before they are scaled up in the market - subject to compatibility with EC guidelines and the acceptability of (and ability to meet) the costs involved.

An independent Scottish Government will be able to introduce, tailor and fund its own initiatives aimed at supporting activity in the renewable and low carbon space. These could encompass measures to promote renewable heat and power, across a range of scales and within communities, and extend out to storage technologies and applications, district heating and potentially carbon capture.

The Scottish Government should aim to conduct, as part of its transition planning, a thorough options analysis - identifying the choices and tools that would be available to it to support and promote the development of renewable and other low carbon technologies, as well as strength and activity within the related supply chains.

Investors need clarity and continuity of policy. Continuity can be addressed by an early confirmation regarding the status of projects already operating under the RO and commitments to the grandfathering of support over the contracted period. However, projects and businesses located in Scotland will also want clarity over their continued eligibility to apply for and receive support under the UK electricity market reform mechanisms currently being finalised, and the terms and conditions under which those schemes will operate.

Export and Trade of Renewable Energy

It is axiomatic that the aspects of renewable generation - namely, its dispersed nature, often remote from large demand centres - creates distinct and wide ranging challenges for the transmission and distribution of the energy generated. This also lends urgency to the pursuit of new solutions which would allow such generation to be stored - economically and at large scale - and used at times which correlate with demand.

The management and operation of the electricity and gas networks - in a way which ensures the delivery of energy as securely, affordably and sustainably as possible - will be an important issue facing Government and Regulator in an independent Scotland. Energy policy and economic regulation must between them deliver the Government's desired outcomes through a least-cost combination of instruments.

The electricity transmission network in Scotland is operated on behalf of owners Scottish and Southern Energy Power Distribution and Scottish Power Energy Networks by National Grid Transmission UK, who also operate the system in England and Wales.

While Scotland's network differs slightly from the rest of the UK, in that 132 kV lines are classed as transmission rather than distribution, it operates under a common set of arrangements governing access and use of system charges. The methodology under which these charges are calculated and applied has been under review for some time. This issue is a contentious one - based on current forecasts, Scotland will have around 12% of total GB transmission connected capacity in 2014-2015, while the generators in question will pay around 35% of total GB use of system charges.

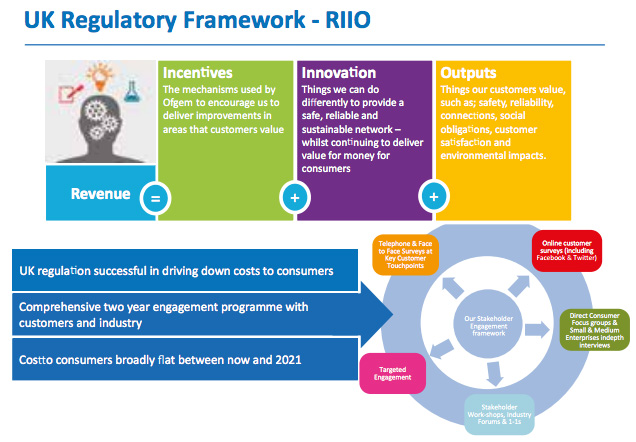

A great deal of investment in Scotland's networks has already been approved by Ofgem under its RIIO model (Revenue = Incentives + Innovation + Outputs). The RIIO-T1 outcome, confirmed in April 2012 [52] , set out final proposals for Scotland's transmission owners to begin taking forward investments worth up to £7.6 billion after inflation, designed to assist with connections for renewable generators through the replacement of ageing infrastructure and the extension of new lines across the country.

(Courtesy of National Grid)

These developments are already providing access to market for large amounts of new renewable generation across Scotland, and will continue to do so. These improvements to the system will take time to progress through the planning and construction phases; the upgraded line between Beauly and Denny took five years from application until the award of consent in 2010 following a public inquiry, and construction of the line is ongoing. However, the Scottish Government has recently proposed the inclusion (as part of its third National Planning Policy Framework) of upgrades to the transmission network as proposed national developments [53] .

These investments, as well as those which have been approved by Ofgem with regard to the transmission of electricity and gas across the UK [54] are taking place, in the context of the needs of the UK as a whole.

They have been designed to strengthen and support trade across the existing single energy market, and to enhance security of supply by ensuring that energy is capable of being transferred from where the resource exists to where it is needed. This ensures the renewable energy resources, which are most concentrated in remote parts of Scotland, are available to help meet demand and targets across the UK as a whole.

The Commission believes that regardless of the outcome of the referendum on 18 September 2014, these needs will endure and that a strong argument consequently exists for the investment costs being shared across the UK.

The issue of connections is particularly acute in the context of the Scottish islands. Moves are underway to introduce a bespoke strike price for island generated wind under the proposed CfD mechanism. This recognises the huge potential resource on Scotland's islands, and the relative merits of the costs involved in tapping into that resource - relative to more expensive technologies such as offshore wind. The Commission supports the joint efforts being undertaken by the Scottish and UK Governments to encourage the development of the energy resources of the Scottish Islands in wind and marine energy and sees this as an area of real potential for both energy generation and social impact.

An independent Scotland would also need to consider the role of 'smart grids' as part of societal changes over the coming years which will fundamentally alter the way in which energy is generated, stored, distributed and consumed. There will be opportunities for Scottish businesses and universities in the research, development and marketing of the technologies which will underpin and emerge from the efforts required to deliver this shift.

EU 2030 Package (looking beyond current Targets)

Discussions are taking place through 2014 amongst EU Member States which will establish the policy framework and targets designed to continue moves towards an integrated and secure low carbon energy market across the Continent by 2030 [55] . The framework which the EU has proposed comprises amongst other measures:

- a target to reduce EU domestic greenhouse gas emissions by 40% below the 1990 level by 2030

- an objective of increasing the share of renewable energy to at least 27% of the EU's energy consumption by 2030

- continued improvements in energy efficiency

- reform of the EU emissions trading system.

This is a matter upon which the current Scottish Government has worked with its UK counterpart - with common ground regarding the intent if not always the precise detail and scope of the EU's chosen approaches.

An independent Scottish Government would of course be free to participate as a member state (subject to that status being achieved) and engage with the EU to pursue policies and outcomes going forward which it believes are in the common interest of Member States and which constitute the best possible means of achieving common goals.

The 2030 framework and policies will meanwhile provide a backdrop for investment in renewable and low carbon energy - and a set of principles governing state subsidies and support - which will have a meaningful influence on investment and development decisions, and with which future Scottish Government policies will need to remain consistent.

Whichever approach or option is taken will need to remain consistent with developing EU policy and priorities governing availability of state support and subsidies.

Contact

There is a problem

Thanks for your feedback