Council Tax for second and empty homes, and non-domestic rates thresholds: consultation

This joint public consultation with COSLA seeks views on giving local authorities the power to increase council tax on second homes and empty homes, as well as considering whether the current non-domestic rates thresholds for self-catering accommodation remain appropriate.

Second Homes

The current position

As at September 2022 there were 24,287[3] second homes (classified for council tax purposes), equating to around 1%[4] of all residential accommodation in Scotland.

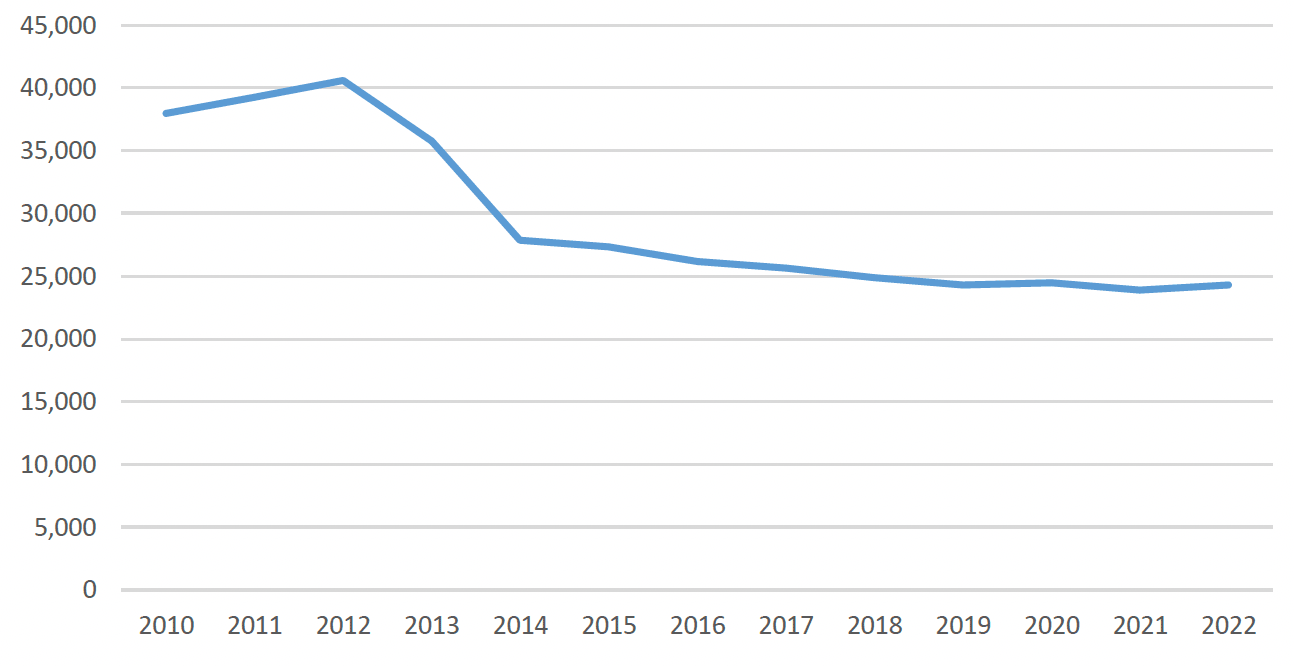

While the overall number of second homes in Scotland has declined by 16,312 in the last decade (see Figure 1), this should be considered in the context of legislative changes made in 2013 and a focus by councils to improve data quality. Both of these factors likely led to the re-classification, for council tax purposes, of a number of homes, resulting in increased numbers of empty homes and a reduction in the number of second homes.

Since 2012, second homes have increased in six of Scotland's 32 council areas. The number of second homes varies considerably between, and within, individual councils, with the peak numbers found mainly in tourist hotspots, rural and island areas. Table 1 shows the proportions of second homes above the national average level of 1%. Further context is set out in the partial Business and Regulatory Impact Assessment published alongside this consultation[5]

| Council Area | Share of second homes |

|---|---|

| Argyll & Bute | 6.2% |

| Na h-Eileanan Siar | 5.9% |

| Orkney Islands | 4.8% |

| Highland | 3.0% |

| North Ayrshire | 2.2% |

| Dumfries & Galloway | 1.8% |

| Moray | 1.7% |

| Scottish Borders | 1.7% |

| Perth & Kinross | 1.6% |

| Shetland Islands | 1.5% |

| Fife | 1.3% |

| Average | 0.9% |

Source: Scottish Government (Housing statistics: Empty properties and second homes - gov.scot (www.gov.scot)) and CTAXBASE 2022)

We have produced a partial Business Regulatory Impact Assessment to accompany this consultation that provides more in depth analysis about the location of second homes across Scotland.

Second Homes - the legislative framework

The Council Tax (Variation for Unoccupied Dwellings) (Scotland) Regulations 2013 (as amended in 2016) ("the 2013 Regulations") set a 50% council tax discount as the default charge for accommodation that is not someone's sole or main residence, and give councils the power to change that discount.

In practice for second homes this means councils can:

- alter the level of discount, to provide a discount of between 50% and 10%

- offer no discount

For second homes, this means a council could decide to charge different amounts of council tax in different parts of their local area.

Schedule 1 of the 2013 Regulations sets out certain categories of second homes that must be given a 50% discount; these are 'purpose-built holiday accommodation' and 'job-related dwellings'. For these, there is no choice but to give a discount of 50%.

- Purpose built holiday accommodation is defined as a dwelling that is used for holiday purposes and has a licence or planning permission limiting its use for human habitation throughout the whole year. An example might be chalets or other types of holiday accommodation that are either unsuitable to be occupied all year round (their construction may mean they are only suitable to be lived in during the warmer months) or are not allowed to be lived in all year due to planning, licensing or other restrictions.

- Job-related dwellings are defined as homes owned by someone who has to live elsewhere for most or all of the time as part of their job, or the home the person occupies to undertake their job if the person has another home that is their main residence.

The case for change

Our aim is for everyone in Scotland to live in safe, secure and warm homes. We need to do more to prioritise housing for permanent accommodation, whether this is in the rented sector or home ownership.

Demand for second homes, especially when concentrated in a particular area, may result in a significant increase in house prices in that area. This can reduce access to affordable residential housing to meet local needs. For example, this can make it harder for local people, particularly young people or those with fewer resources, to find homes to live in and cause outward migration. Low occupancy of second homes, even if used partially as short-term lets, may also minimise the economic contribution to local communities that is important to sustain local public services. Services can also be affected if it is difficult to recruit and retain key workers because there is a lack of affordable housing close to where they work.

The proposals set out in this consultation aim to encourage second home owners to use their accommodation differently, for the benefit of local communities. If an owner were to change how they use their second home from personal use to a private rental tenancy, this could help increase supply in the private rented sector.

Some homes in certain areas, however, may not be suitable or desirable for year-round occupation. This may be because of their construction/ location or because of seasonal demand/ insufficient infrastructure. In these instances, residential accommodation used as short-term lets or second homes can contribute positively, in many cases preventing homes being left empty.

Where communities are reliant on the seasonal tourist economy, there is a balance that needs to be found between local housing needs for residents, housing for seasonal workers and accommodation for tourists. This was evident during 2022 when businesses and public services in tourist hotpots, such as Aviemore and Skye, cited the lack of available accommodation as one of the contributory factors for staff shortages. This points to an imbalance in the availability of accommodation for primary residences and the knock on effect it can have on local economies, as reported by a UK Hospitality report.

Taxation is one measure that can support local areas to reach the right balance for their local circumstances, as a means to influence ownership patterns and the detrimental impact they can have on the availability of homes to meet local needs. Enabling councils to apply a premium on council tax on second homes could also generate additional revenue that could be used to benefit the local community and contribute to affordable housing schemes.

The majority of councils already choose to charge second home owners the full rate of council tax, which is the maximum they are able to apply within the current legal framework[7]. The remaining seven councils apply a 10% discount for second homes, although in Orkney this only applies for 12 months.

Second Homes proposals for consultation

We recognise there may be benefits for councils to have the same discretionary powers for second homes and long-term empty homes.

This consultation is seeking views on granting councils more discretion over the rate of council tax on second homes by:

- introducing additional powers that enable a premium of up to 100%

- introducing additional powers that enable a premium of greater than 100% to be applied to both second (and long-term empty) homes

The discretionary nature of these additional powers would mean that councils could still decide whether and how to utilise them based on local circumstances, including balancing the needs and concerns of their communities with wider economic and tourism interests.

We recognise that individuals have the right to own more than one property. In considering changes to the council tax treatment of second homes we therefore wish to ensure there is a fair balance between the general interest and the rights of those affected. The intention is that second home owners be encouraged to make a contribution to the local area in which their accommodation is located. This could happen, for example, by making it available for let as a private rental tenancy or otherwise being liable to pay higher council tax.

In setting out the proposal for councils to have powers to charge a premium on second homes, this consultation asks for your views about the factors that should be considered locally before reaching a decision to charge more.

Factors that could be taken into account for premiums on second homes

Councils could consider a range of factors when deciding whether to introduce a premium.

A non-exhaustive list of potential factors is set out below:

- numbers and percentages of second homes in the local area

- distribution of second homes and other housing throughout the council area and an assessment of their impact on residential accommodation values in particular areas

- potential impact on local economies and the tourism industry

- patterns of demand for, and availability of, affordable homes

- potential impact on local public services and the local community

- other existing measures or policies that are aimed at increasing housing supply and the availability of affordable housing

Councils may also decide not to use the powers or to disapply a premium for a specific period of time.

A non-exhaustive list of examples of where a council might consider doing this include:

- where there are reasons why the home could not be lived in as a permanent residence

- where there are reasons why a home could not be sold or let

- where the owner's use of their accommodation is restricted by circumstances not covered by an exception from the premium

- where charging a premium might cause hardship

Notification period

Councils are independent bodies, democratically elected and accountable to their local electorate. Deciding whether to increase council tax is a matter for them as part of their own internal governance. This includes any consideration as to how, and when, best to notify their own local electorate of any forthcoming changes to local taxation.

Contact

Email: secondemptyhomes@gov.scot

There is a problem

Thanks for your feedback