Mobilising private investment in natural capital: report

This report looks at how to encourage responsible private investment into peatland restoration, including how to overcome barriers to scaling voluntary carbon markets to restore peatland in Scotland.

Section 7: Scotland Carbon Fund

Overview of the mechanism

The purpose of this section is to review the key design features highlighted in section 2 of this report. It will highlight the options most likely to incentivise participation from the various stakeholder categories, and create a high-integrity market to enable Scottish peatland restoration at scale.

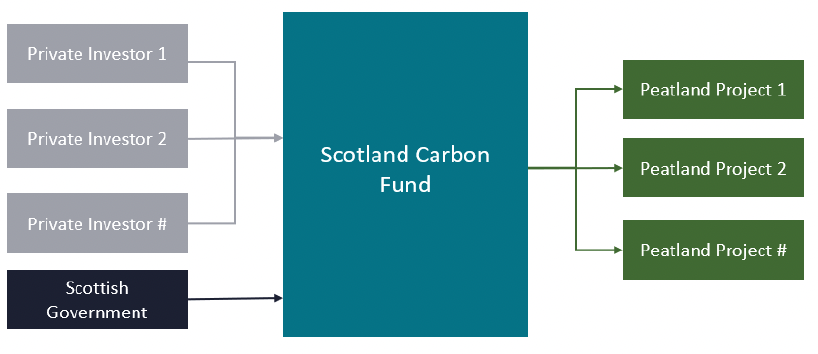

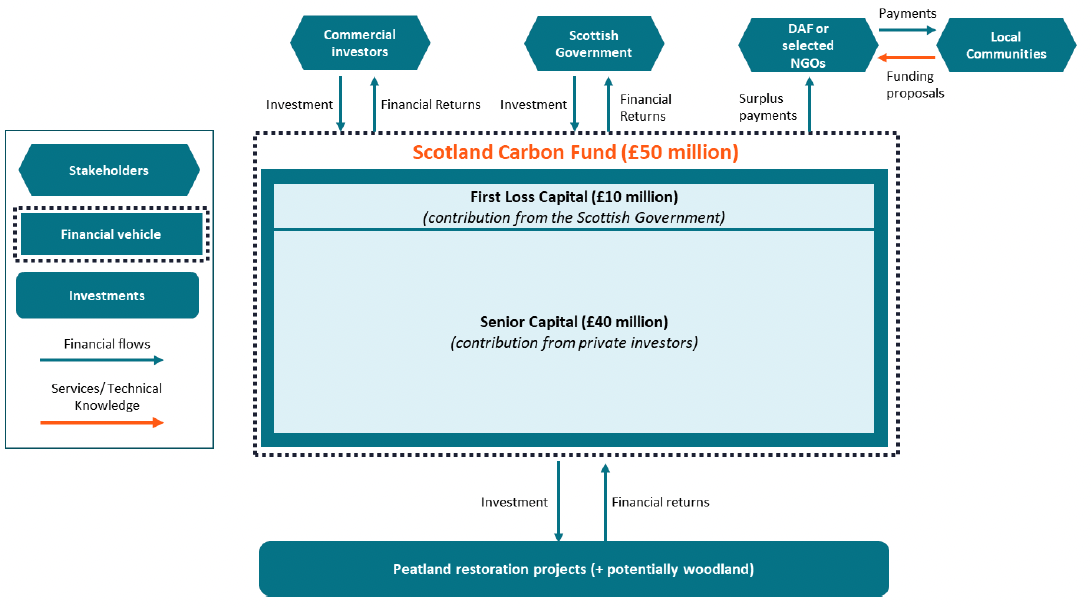

The purpose of the Scotland Carbon Fund (SCF) would be to act as an investment vehicle to enable private capital to invest in high-quality peatland restoration projects in exchange for financial returns generated from the sale of carbon credits, as illustrated in Figure 9 below. The SCF aims to enable the scaling of peatland restoration in Scotland by leveraging public capital provided by the Scottish Government to crowd in private investors.

Recommended design options

Fund function

Two possible fund functions were considered: a liquidity vehicle and a project finance vehicle.

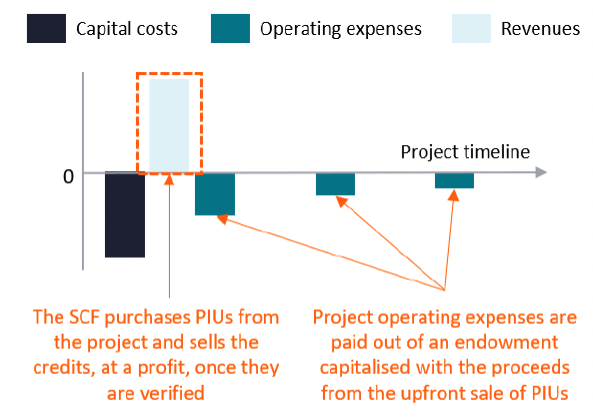

As a market liquidity vehicle, the SCF would act as a guaranteed offtaker of PIUs, buying these credit from projects upfront and holding onto them until they vest into PCUs. According to this model, peatland projects receive a one-off upfront payment from the sale of PIUs to the SCF (as shown in Figure 10 below). SCF investor returns are generated by the expected increase in value of the credits over time and through verification.

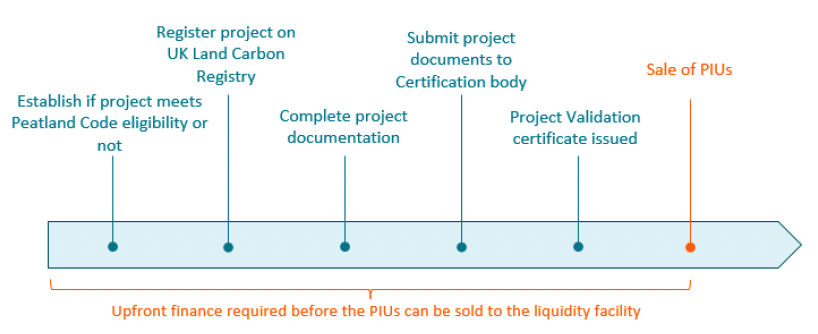

To be noted, a project selling its PIUs to the liquidity facility would still require some upfront finance to bridge the time gap between when the some of the early upfront costs are incurred, and when PIUs are sold. This is illustrated in Figure 11 below.[43] For projects that undertake restoration works before PC validation, Peatland ACTION funding could help to close the financing gap, however costs related to the development and validation process under the PC are not eligible and therefore would need to be covered by other forms of finance.

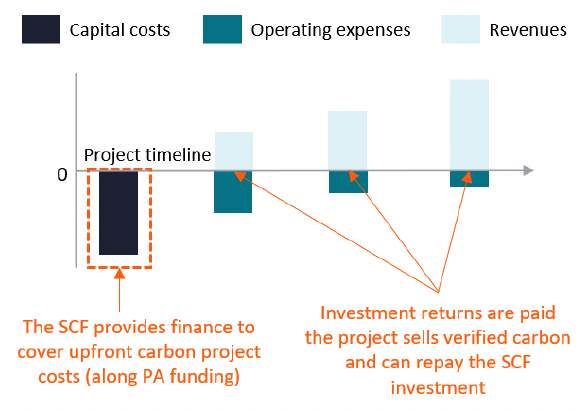

As a project finance vehicle, the SCF provides project developers with finance to support the delivery of peatland restoration, bridging the time gap between project development and revenue generation. Investment returns are paid once PIUs vest into verified PCUs and are sold.

The stakeholder engagement process revealed a bias towards projects holding PIUs for future sale / use. This trend is being driven by market sentiments of rising demand and prices for verified carbon (PCUs), together with delivery risk associated with the early stages of project development.

This trend is well suited to a project finance vehicle with revenues realised over a longer time frame. In contrast, the declining interest in the immediate sale of PIUs (given widespread expectation of increasing carbon prices and concerns about selling carbon credits that might be needed to offset landowners' own emissions) undermines the attractiveness and potential role for a liquidity vehicle. A more detailed analysis of the considerations relevant in choosing a fund function is developed in Table 10 below.

| Objectives |

Project finance vehicle |

Liquidity vehicle |

|---|---|---|

| Enables high-integrity and good governance |

High, the project finance vehicle would incentivise projects to keep their PIUs until they vest into PCUs. Selling PCUs creates a better temporal alignment between revenues from the sale of verified carbon and project operating expenses. It also generates extra revenues for the project that would have otherwise been captured by market intermediaries buying the PIUs. |

Medium, the liquidity vehicle would purchase PIUs from projects upfront, perpetuating the current transaction structure which might lead to the underfunding of future operating expenses, and the concentration of benefits of the sale of carbon in the hands of the present generation (unless an adequate endowment or revenue sharing agreement is set to ensure the long-term financial viability of projects). |

| Attractive to private investors |

Medium, project finance vehicles are very common and well known to institutional investors, for instance in the renewable energy and forestry sectors. However, project finance in the nascent nature-based sector involves significant risks (e.g., project failure) that might curb the enthusiasm of some investors. |

Low, liquidity vehicles are less common in the market and institutional investors (which are able to provide the large amounts of capital necessary to scale peatland restoration) are less likely to be familiar with them. Additionally, the vehicle would need to pursue the dual objectives of providing liquidity to the market and generating a return for investors. This might create tensions, for instance a stringent eligibility criteria might limit the fund's ability to fulfil the mission of providing liquidity to the market. |

| Attractive to landowners and project developers |

Medium, provided that the project finance vehicle offers an equitable share of the benefits from the sale of carbon to landowners and project developers. Additionally, the project finance vehicle can provide an all-inclusive upfront finance package allowing project development to move forward with maintenance for the early years of the project when delivery risk is the highest. |

Low, landowners are increasingly cautious of selling their PIUs upfront and therefore might be reluctant to engage with a liquidity facility (this issue could potentially be resolved with a profit sharing mechanism). Additionally, the early project delivery risk is not shared with the liquidity facility which only purchases the PIUs once the project development phase is concluded. |

In conclusion, the analysis identifies the project finance vehicle as a better fit given the current needs of the market and preferences of market actors, such as private investors and landowners. A project finance vehicle could be paired with a PFG (reviewed in the next section) to help set strong governance standards for the peatland carbon market by incentivising projects to keep PIUs until they vest into PCUs.

Fund general characteristics

The size of the SCF would need to be determined by the availability of pipeline, the breadth of the investment mandate and restoration targets. It remains difficult however to estimate the size of the potential pipeline of peatland projects eligible to generate carbon under the PC's eligibility criteria. Positively, in late 2022 the PC is expected expand the types of peatland eligible to include lowland fens and agricultural peatlands. This may increase the availability of pipeline, although it should be noted that a significant portion of the peatland in Scotland is already in caterogies currently eligible under the current PC (i.e., upland blanket bog or lowland raised bog). Using NatureScot's average restoration cost estimates of £1,900 per hectare of peatland restored[44], acknowledging that fenland and agricultural peatlands are likely to incur higher restoration costs per hectare than upland peatlands, a £50 million fund could finance the restoration of c. 105,000 hectares of peatland (assuming a Peatland ACTION contribution of 75% of the capital costs) and use the PC to sell carbon in order to pay a return to investors.

Smaller funds tend to be less economical to run due to significant fixed costs (e.g., investment professionals' salaries, back and middle office infrastructure expenses, etc.) so positive economies of scale are generated as fund size increases. Based on this analysis, and assuming that the fund would target institutional investors (which tend to have multi-million minimum investment thresholds to meet in order to participate in funds), the SCF should target a size of £50 million or more.

It is worth noting, as evidenced in Table 11 below, that most funds operating in the natural capital space are larger than £50 million. There are two notable examples below that threshold in the table below: the Livelihood Carbon Fund #1 and the SLM Silva Fund (Ireland). However, both these funds led to the creation of larger funds subsequently (i.e. the Livelihood Carbon Fund #2 and #3, and the SLM Silva Europe Fund).

| Fund Name |

Fund Manager |

Fund size |

|---|---|---|

| Athelia Sustainable Ocean Fund[45] |

Mirova |

US$132 million (equivalent to £123 million) |

| Land Degradation Neutrality Fund[46] |

Mirova |

US$200 million (equivalent to £186 million) |

| Livelihood Carbon Fund #1[47] |

Livelihoods Funds |

€40 million (equivalent to £36 million) |

| Livelihood Carbon Fund #2 |

Livelihoods Funds |

€100 million (equivalent to £89 million) |

| Livelihood Carbon Fund #3 |

Livelihoods Funds |

€150 million (equivalent to £134 million) |

| Foresight Sustainable Forestry Company[48] |

Foresight Group |

£175 million |

| SLM Silva Fund (Ireland)[49] |

Sustainable Land Management (SLM) Partners |

€30 million (equivalent to £27 million) |

| SLM Silva Europe Fund[50] |

SLM Partners |

€250 million (targeted) (equivalent to £223 million) |

A project finance vehicle typically has a lifecycle of several years including a deployment period (which could be 3 to 5 years), during which funds are invested, and a holding period (which could be 5 to 10 years, as commonly seen for project finance and private equity vehicles, and allowing for the peatland projects to be well established), during which investments are managed and optimised / de-risked, prior to exit. As a result, the SCF could have a lifecycle of 10 to 15 years.

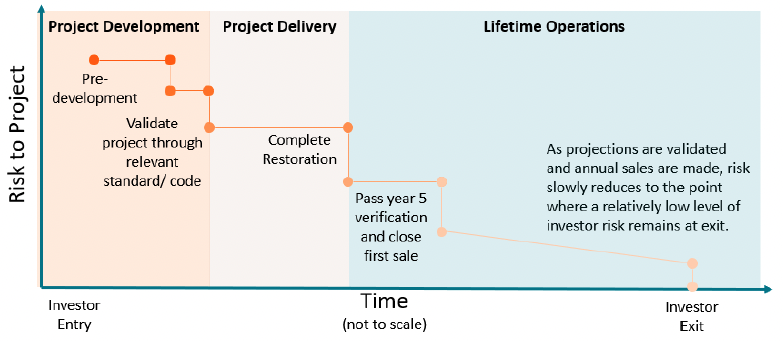

Figure 13 shows that project risk decline as that project matures and becomes more established. Once investments are de-risked (i.e. once the peatland ecosystem is well established, maintenance costs are declining, and some PCUs have been succesfully verified/ sold), the vehicle can sell them to long-term investors seeking lower risk investments. Long-term investors for peatland projects do not yet exist but an ad hoc, "yieldco" could be created to hold the assets over the long term. This is a process well known to investors and commonly used for investments in infrastructure (e.g. renewable energy assets).

The stakeholder engagement process also revealed that it might be attractive for some investors to have the option to choose between receiving their returns in kind (in carbon credits) or in cash. The former would consitute an attractive proposition to investors seeking to secure in advance a reliable supply of carbon credits to fulfil their own internal GHG emissions offsetting targets.

Investment mandate

Peatlands can often be found adjacent to woodland habitats and thus there may be opportunities to combine restoration activities across both habitats to deliver integrated landscape-level restoration. The creation of new woodland and restoration of peatland can both be enabled by issuance and sale of carbon credits through high-integrity certification schemes. As such, it is worth exploring expanding the investment mandate of the SCF to woodland carbon.

The inclusion of woodland carbon in the SCF would generate benefits to investors by enabling a better diversification of the portfolio of investments, which would reduce the overall financial risk of the fund, and allow the fund to deploy capital faster, by expanding the pipeline to woodland, which is a more mature investment opportunity with potentially stronger pipeline availability.

If the investment mandate was expanded to woodland, the inclusion of a minimum target allocation to peatland projects might be required in order to limit the incentive to allocate all the resources of the fund into less risky, more mature woodland creation projects. Additionally, a detailed analysis of the woodland creation pipeline and financing requirement would need to take place as well.

The stakeholder engagement process identified that capacity constraints across the peatland restoration value chain (e.g., contractors, Peatland ACTION officers, project auditors, etc.) currently limit the ability scale peatland restoration. Therefore, the SCF should also consider the introduction of a distinct strategy which would invest in the businesses contributing to the delivery and maintenance of peatland projects. This strategy of investing in enterprises operating across the supply chain and undertaking activities supporting the development of peatland restoration (e.g., sphagnum moss growers, diggers, standards bodies, etc.) would help to ensure a coherent and integrated approach to peatland restoration. These investments would likely take the form of an equity contribution in exchange for a minority stake in those companies. This strategy departs from the project finance investment model developed earlier in this report; it would require additional resources to be implemented and potentially alter the risk/return profile of the SCF.

The investment mandate should also consider the trade-offs between freehold and leasehold investment strategies. The advantages and disadvantages of each are summarized in Table 12 below. Given the objectives of the Scottish Government to limit land price increases, the SCF should favour a leasehold strategy.

| Strategy |

Description |

Advantages |

Disadvantages |

|---|---|---|---|

| Freehold |

The SCF purchases the lands on which peatland restoration projects are located. |

This strategy gives more control over the project. Purchasing the land also could provide an additional source of return for investors, in the form of capital appreciation from the land owned. |

This strategy may fuel further land price increases and price out local communities. Land prices have risen aggressively in response to demand for woodland planting sites in recent years. It is also capital intensive (i.e. the SCF would need to allocate resources to purchase land in addition to financing project development costs) and relies on the availability of peatland for sale. Finally, this strategy might lead to increased concentration of land ownership into the hands of a few large investors, which runs counter to the Government's Interim Principles for Responsible Investment in Natural Capital. |

| Leasehold |

The SCF enters a lease agreement with the owner of the land on which peatland restoration projects are located. |

This strategy limits further concentration of land ownership into the hands of large investors and is less capital intensive. It also allows to tap the expertise of and work in collaboration with local landowners. If the SCF were to favour leasehold transactions, a carve out for community-led land acquisitions should be considered. |

This strategy gives less control over the outcomes because it requires cooperation with the landowner(s) over long periods of time. |

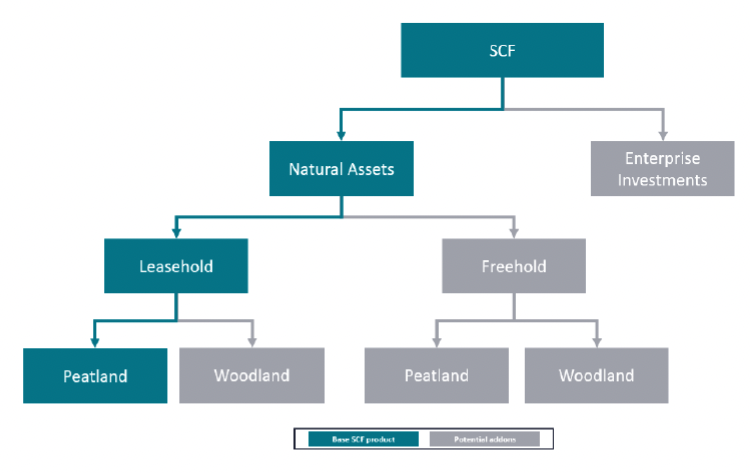

In conclusion, there is potential benefit in expanding the SCF's investment mandate beyond peatland carbon projects to better support the market, and improve attractiveness to investors through diversification and faster deployment of capital. However, the inclusion of additional investment opportunity types would warrant further analysis. Figure 14 below illustrates the various investment buckets that could be created within the SCF. To be noted, "natural assets" investments would use the project finance model described earlier, whereas "enterprise investments" would likely use a private equity model (i.e., making an equity investment into the capital of companies in exchange for a share of the returns and ownership).

Government contribution

A potential financial contribution from the Scottish Government to the SCF was perceived as a crucial stamp of approval and display of commitment to the peatland carbon market by the investors consulted. There are two main options for the Scottish Government to make a contribution:

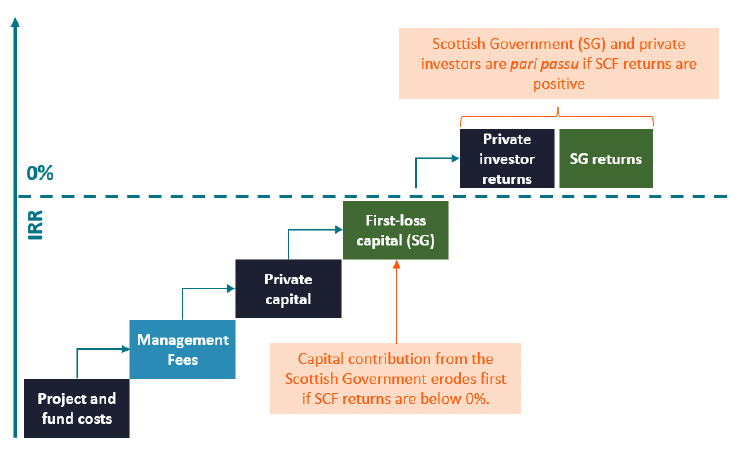

A pari passu contribution: in this scenario, the Scottish Government would be entitled to the same returns and exposed to the same capital loss risks as private investors; or

A subordinated contribution: in this scenario, the Scottish Government would take a first-loss position on the capital invested in the fund and/or on the returns generated by the fund.

A subordinated capital contribution from the Scottish Government, in the form of a first-loss guarantee or similar arrangement, was identified by investors as an attractive proposition during the stakeholder engagement process. Private investors currently perceive peatland restoration as risky, due to the range of factors outlined earlier and first-loss guarantee would reduce the risks of investing in the SCF, therefore playing a key role in crowding in private capital.

Figure 15 illustrates a scenario in which the Scottish Government has a taken first-loss position in the capital of the fund, but is pari passu with other investors if the fund generates positive returns.

Community benefits

In order to ensure that peatland restoration contributes to the Scottish Government's objective of a fair, just and green future for all[51] through Community Wealth Building, the SCF should be structured in a way that enables communities to benefit while still representing a compelling investment opportunity for private investors.[52] At the same time, expectations that a community benefit mechanism could leverage large amounts of money for communities must be carefully managed. Surpluses generated in the early years of the development of the peatland carbon market are likely to be limited based on the low carbon market prices compared to the significant cost of peatland restoration.

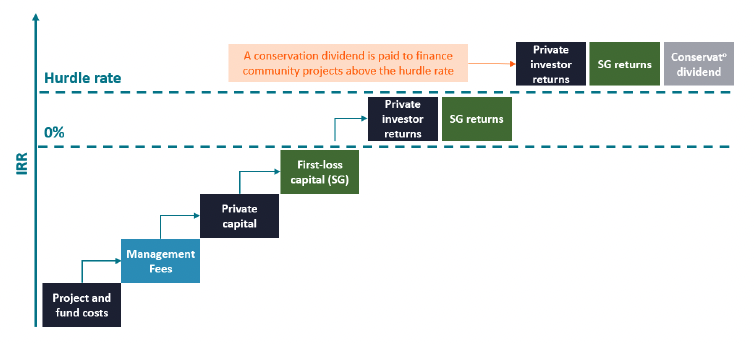

The SCF could enable the sharing of community benefits at a fund level by creating a surplus sharing mechanism (such as a conservation dividend) that activates above a pre-negotiated hurdle rate. The hurdle rate should be negotiated between the investors and communities at a level that ensures a fair and attractive level of financial returns to both stakeholder groups. Above the hurdle rate, a certain proportion (to be defined) of the returns that would normally accrue to the Scottish Government and the private investors would be paid to communities.

Figure 16 illustrates how the a surplus sharing mechanism and hurdle rate could operate in the distribution of returns waterfall.

The surpluses generated could be channelled to communities either through a Donor Advised Fund (DAF) or via donations to a pre-agreed list of charities. It is worth noting that a DAF would be more expensive to set up and operate, but would give a greater degree of control over the end-use of proceeds.

The SCF should also aim to maximise local communities' involvement in peatland restoration projects, to create local jobs and livelihoods. In order to do so, the SCF could create and fund a training programme aimed at providing local communities with the skills required to participate in peatland restoration projects. For instance, Tilhill and Foresight Sustainability Forestry Company Plc are running the "Foresight Sustainable Forestry Skills Training Programme" to provide communities with the skills required to perform forestry jobs.[53] This could be replicated in the peatland restoration sector, building on capacity building work led by Peatland ACTION to date.

Endowment and risk-sharing mechanisms

An endowment mechanism may be useful to ensure that the lifetime costs of projects are adequately provisioned. The projects would contribute a certain proportion of their revenues from carbon sales to the endowment. The amount contributed by the projects should be a function of the modelled project lifetime cost, ideally secured in long-term service contracts with maintenance providers, and the portion of PIUs sold upfront (i.e., the more PIUs are sold upfront, the higher the contribution required to the endowment).

A central endowment designed to cover the project lifetime costs of all projects in the SCF portfolio would present the benefit of being more cost efficient, more resilient, and easier to invest in than separate endowments created for each project.

The stakeholder engagement also highlighted the need for mechanisms to mitigate project delivery risk in order to obtain the support of landowners to restore peatlands. The use of portfolio-wide insurance contracts could mitigate the risk of cost overruns due to external factors (such as extreme weather events that might become more prevalent over the long-term time horizons of peatland projects), thereby overcoming a major hurdle in obtaining landowners' buy in. More research and engagement with insurance companies would be required to determine the appetite of insurance providers for peatland restoration projects. However woodland and forestry insurance products are already well established and widely available to landowners, setting a precedent for peatland insurance products.

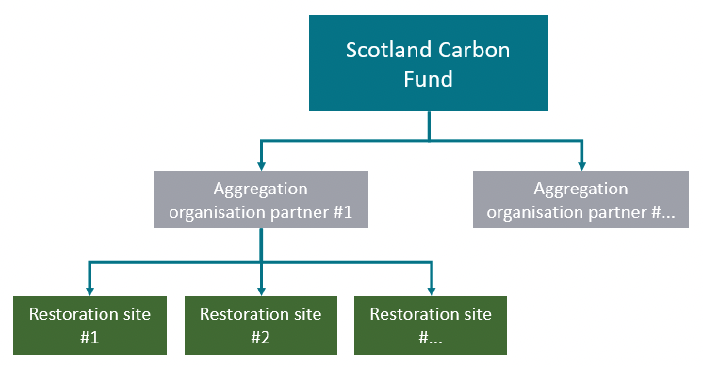

Project aggregation

Stakeholder engagement revealed that the small size and fragmentation of projects significantly increased transaction and origination costs for investors. In order to minimise this issue, the creation of aggregation facilities might be needed. Aggregation facilities would enable the SCF to offer financing to several small size projects at once, thereby reducing transaction and origination costs (Figure 17). Aggregation is also likely to have a positive effect on project costs, with efficiencies of scale realisable for both capital works and maintenance activities.

Typically, aggregation facilities can provide a pre-defined amount of investment capital to project aggregator partners (existing or to be created) such as eNGOs (e.g., RSPB) and regional partnerships (e.g. Tweed Forum) that will source a pipeline of projects. For instance, a regional partnership such as the Tweed Forum could coordinate landowners in the Tweed catchment area to deliver landscape-scale peatland restoration, with the SCF providing a pool of money for the catchment area as a whole instead of financing each landowner separately. This approach could also feed directly into structured aggregator models such as Landscape Enterprise Networks (LENs)[54] and Regional Land Use Partnerships (RLUPs)

Key takeaways

- A project finance vehicle with a targeted recommended size of £50 million (or more depending on the inclusion of woodland in the investment mandate) would help to leverage significant private capital to scale the restoration of peatlands while promoting good market governance by enabling projects to keep the flexibility to decide when to sell their carbon.

- Some investors would like to have the option of choosing between receiving their returns in kind (in carbon credits) or in cash. The former would consitute an attractive proposition for investors seeking to secure in advance a reliable supply of carbon credits to fulfil their own internal GHG emissions offsetting targets.

- A first loss protection would likely constitute a compelling investment proposition for private investors otherwise hesitant to participate in the nascent natural capital sector.

- Expanding the mandate of the SCF to invest in woodland could achieve diversification benefits and greater fund scale (which implies a more efficient cost structure).

- The SCF should provide community benefits. It could do so by creating a surplus sharing mechanism that is activated above a hurdle rate negotiated between investors and communities.

- The creation of a central endowment structure would ensure that the lifetime maintenance costs of projects are covered and the use of further insurance mechanisms to mitigate delivery would be beneficial to attract landowners' interest.

- The use of project aggregators and aggregation facilities can reduce the origination and transaction costs associated with the financing of small projects.

Table 13 below provides a summary of the risks identified in the development of the SCF and the mitigations identified through the mechanism design and action research processes.

| Risk |

Mitigation |

|---|---|

| The SCF drives further increases in land prices. |

The SCF can focus on, or be limited to, leasehold models to prevent a rush for land acquisition. |

| The SCF is not able to access a large enough investment pipeline. |

The SCF's investment mandate should include supply chain businesses and other carbon landscapes, in particular woodland. Additionally, further strategic assessment of the peatland resource in Scotland to estimate PC eligibility will be required. |

| The SCF is unable to attract private investment at a competitive price. |

The introduction of concessionary first loss capital will offer confidence to private investors while reducing risk. This will also act to reduce return requirements / expectations. |

| Benefits generated by the SCF are not shared with the local community. |

The SCF can be structured to share a portion of profits generated locally, and use risk sharing and transfer mechanisms to ensure restoration is delivered, and maintained to a high standard. |

| Small scale projects are excluded from the market. |

The SCF will allow for project aggregation and will build standardised contracts / documents to reduce friction costs for smaller projects. |

| There is uncertainty over the possible scale of cost overruns, especially for maintenance. |

The SCF can be structured with governance tools to provide assurance to lenders. This includes endowment and risk-pooling / portfolio structures. Additionally, insurance options to guarantee the amount of carbon generated by a project will need to be considered. |

Figure 18 combines the recommended design options into an illustrative structure for the SCF.

Contact

Email: peter.phillips@gov.scot

There is a problem

Thanks for your feedback