Team Scotland's Export Promotion Support: evaluation

Summary findings of an evaluation of delivery partner support and services offered to businesses with export sales projects in Scotland between April 2018 and April 2021.

5. Profiles of beneficiaries and support provided

5.1 Supported firms were overwhelmingly (99.2%) small to medium-sized enterprises (SMEs). On average, they employed 21 staff, had a turnover of £3.1m and had been operating for 20 years. In terms of the classification of firms in ATN, 87 respondents were classified in this way, with the breakdowns as follows[4]:

- "Born global" (38%)

- "Sleeping giants" (36%)

- "Solid performers" (23%)

- "Top performers" (2%)

- "Starting out" (1%)

5.2 Additionally, supported firms operated in a variety of sectors, most notably in manufacturing (see table 2 below).

| Business sector | % of firms |

|---|---|

| Manufacturing | 33.7% |

| Professional, scientific, and technical activities | 11.7% |

| Information and communication | 8.7% |

| Wholesale and retail trade; repair of motor vehicles and motorcycles | 8.7% |

| Electricity; gas, steam, and air conditioning supply | 8% |

| All other sectors | 29.2% |

5.3 Analysis showed that 60% of beneficiary respondents were current exporters (had exported in the past 12 months). Of them, 49% exported goods, 30% exported services and 21% exported both. In 2021, firms' exports were valued, on average, at around £2.5m and the average firm had been exporting for 14 years. Nearly two-thirds (65%) of respondents exported to an ATN market. Figure 3 below shows the top 5 exporting partner countries that beneficiary respondents exported to.

Figure 3: Top 5 Export partner countries for beneficiary survey respondents

- USA (61%)

- Germany (44%)

- France (41%)

- Netherlands (39%)

- Canada (38%)

5.4 Of the 40% which had not exported in the previous 12 months, the majority, 73%, had never exported (or were yet to), and 27% had last exported in 2020-21. The majority of firms supported by HIE and SCC did not export. It is important to recognise that the support provided by HIE and SCC is intended to stimulate the pipeline of exporters who can then be offered more intensive support by SDI, so are likely to work with a greater percentage of early-stage and non-exporters.

5.5 Management information data shows that 79% of firms were supported by SE/SDI, 10% by HIE, 4% by SCC trade missions, and 7% by two partners. On average, firms accessed 3.6 support activities. In terms of the year of support, this was as below. This profile is important because firms supported more recently will have had less time for exporting and other impacts to be realised.

- 14% in 2018-19

- 26% in 2019-20

- 36% in 2020-21

- 24% in multiple years.

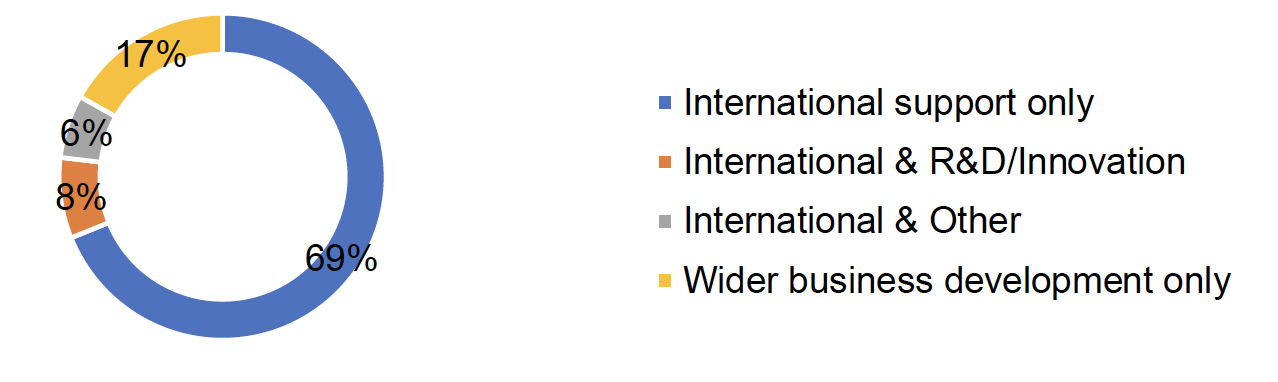

5.6 Given that other types of support, beyond international support, can also stimulate exporting (such as innovation support), firms receiving wider support were included in the sample. This is shown in figure 4 below.

Figure 4: Types of support

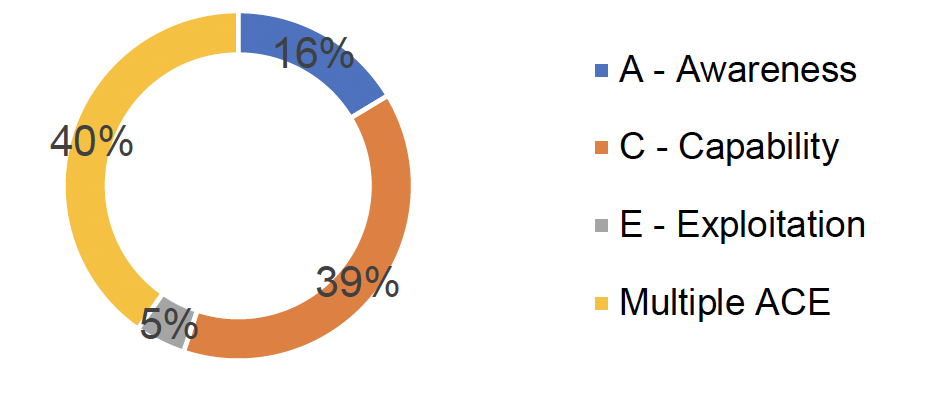

5.7 SDI have traditionally segmented their various types of support into three, broad categories, summarising the pipeline of support as the ACE model[5] (Awareness, Capability and Exploitation) with firms at different stages of their export journey offered different types of support within this framework. The breakdown of support against this framework is shown below.

Contact

Email: jonathan.edosomwan@gov.scot

There is a problem

Thanks for your feedback