Agricultural food and drink sector - impact of future UK Free Trade Agreement scenarios: research

This research assesses the impacts of future Free Trade Agreements (FTAs) between the UK and four selected non-EU trading partners on key Scottish agricultural sectors. The work combines trade-model and farm-level analysis, supplemented by industry interviews and desk-based research.

8. Implications for Scottish Agri-Food and Farming

8.1 Introduction

This Chapter examines the potential impacts of the non-EU FTAs on the Scottish food and farming industry. Section 8.2 provides background information on how the Main Baseline results should be interpreted, as these comments are relevant for the subsequent analysis of Scottish agri-food (section 8.3) and farming (section 8.4).

8.2 Interpreting the Main Baseline Results

Caution needs to be exercised in interpreting the Main Baseline results in this Chapter. This is because, the Main Baseline takes account of both Brexit and non-Brexit factors which are expected to influence long-term prices. As a full comparison between Brexit and an alternative, No-Brexit, scenario was not within the scope of this study, the results of the Main Baseline scenario must be viewed in this context.

As alluded to in Chapter 6, and explained in further detail below, the differences between the Main Baseline and the base year are not solely down to Brexit. Indeed, across all commodities, other factors play a much more important role. This includes an erosion of the UK's competitive position for the selected agri-food commodities over the long-term as well as a continuation of the historic trend of reducing real-terms prices for agricultural produce as predicted by the Prebisch-Singer Hypothesis which contends that commodity prices follow a relative downward trend over time[25]. This trend arises due to increased productivity, including increasing yields and technological growth over time. This effect is illustrated in Table 8‑1 which shows the long-term commodity price changes under both scenarios versus the Base Year.

| Parameter | Wheat | Barley | Dairy | Beef | Sheepmeat |

|---|---|---|---|---|---|

| Main Baseline (Incorporating Brexit) | -3.2 | -3.4 | -5.7 | -4.1 | -3.6 |

| Alternative Baseline (No Brexit) | -4.5 | -4.5 | -4.9 | -3.0 | -2.5 |

Sources: Wageningen University and Research (WUR) and Andersons

8.3 Implications For Scottish Agri-Food

Taking account of the MAGNET modelling results presented in Chapter 7, this section assesses the implications of the selected non-EU FTAs on the Scottish agri-food industry. This is achieved by taking the projected GVA and pricing impacts by scenario and applying these percentage changes to Scottish output and estimated prices during the 2018 to 2020 period (Base). The 2018 to 2020 Base data is obtained from the Scottish Government's Economic Report on Scottish Agriculture (ERSA) publication. The implications for the potatoes' industry are discussed in the next section.

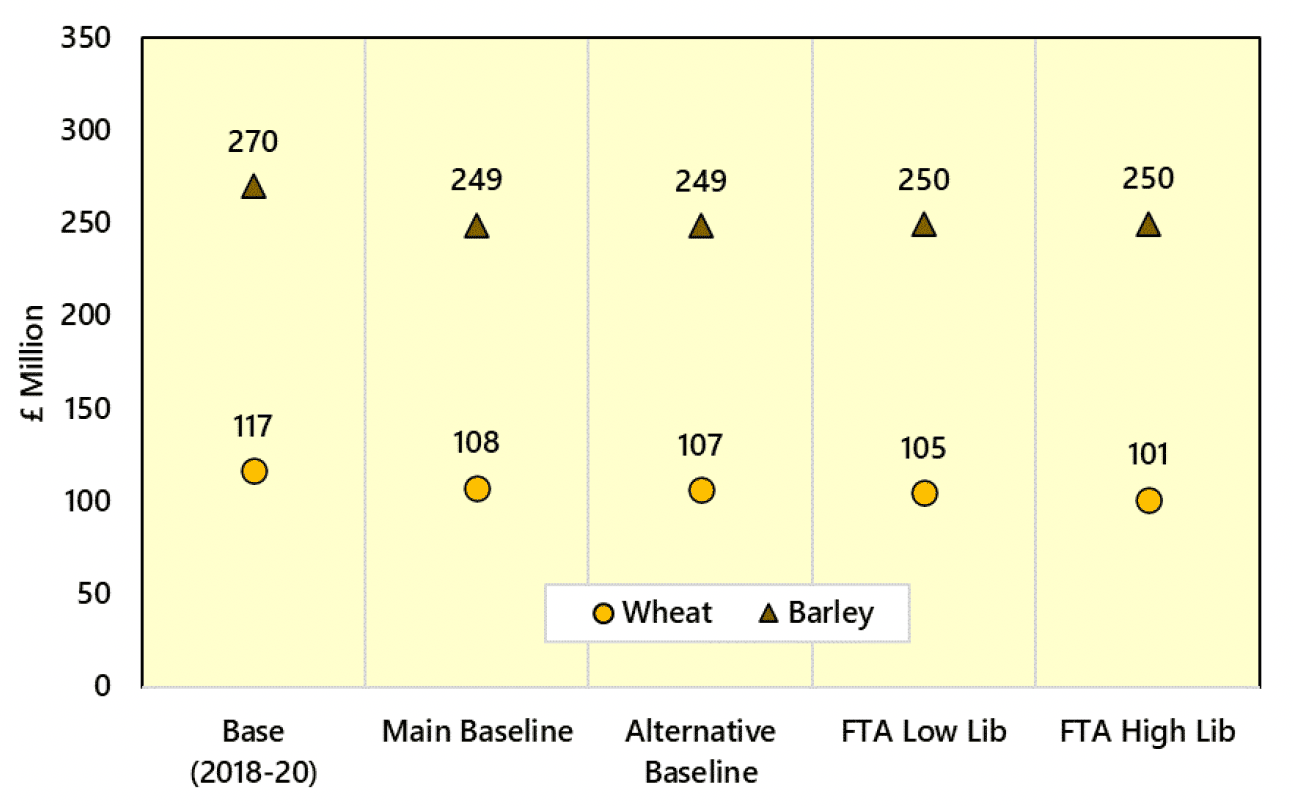

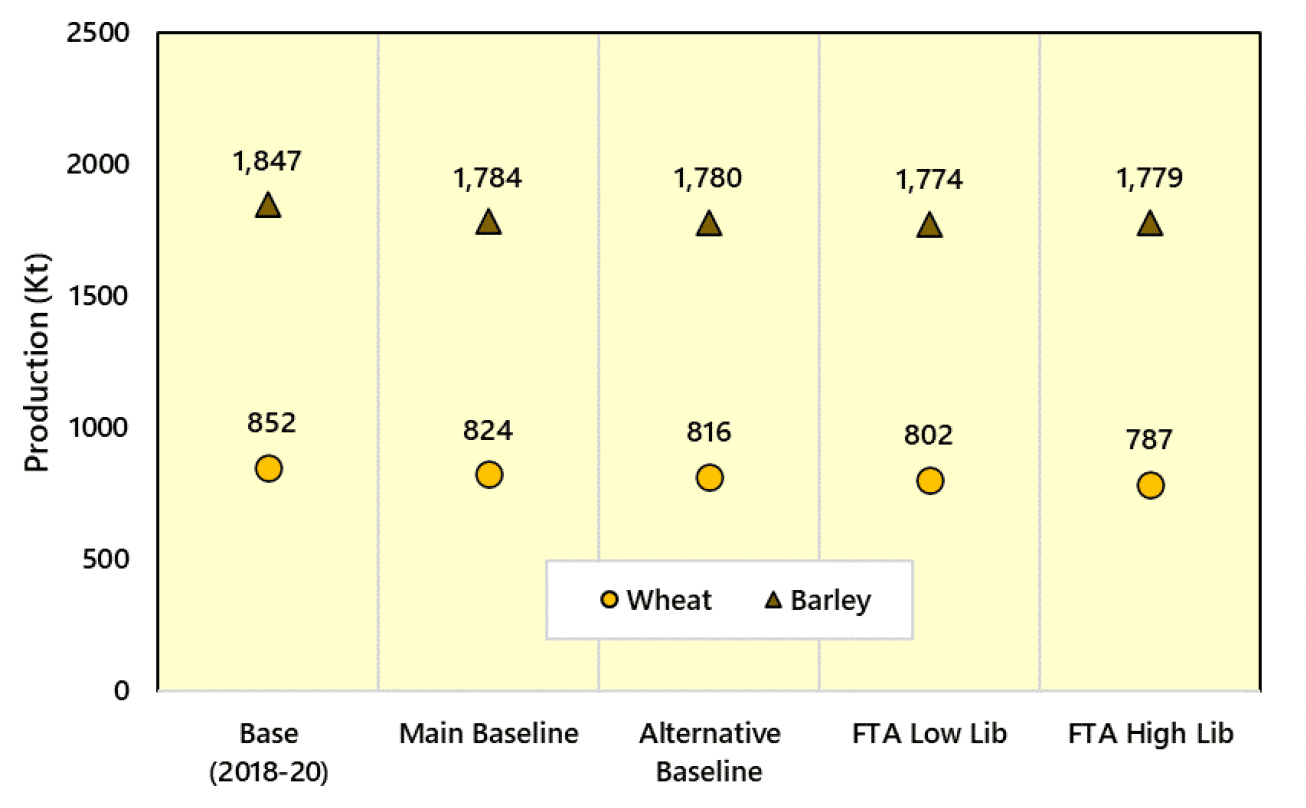

8.3.1 Cereals

Figures 8-1 and 8-2 compare the estimated long-term impacts of each scenario on Scottish cereals output and production respectively, vis-à-vis the 2018-2020 Base. It shows that there are minimal differences in output, for both wheat and barley, between the Main Baseline and Alternative Baseline. This suggests that the impact of Brexit will be limited in the long term and, if anything, there would have more pronounced production declines, particularly for wheat, had Brexit not occurred.

When the non-EU FTAs are factored into consideration in the Low and High Liberalisation FTA scenarios, the monetary value of barley output increases slightly against the Main Baseline. However, against the 2018-2020 Base, the value of both wheat and barley output declines in real-terms, in both scenarios. As explained in Chapter 6 above, this is chiefly due to increased competition from Canadian wheat.

Sources: The Andersons Centre and Wageningen University and Research (WUR)

Sources: The Andersons Centre and Wageningen University and Research (WUR)

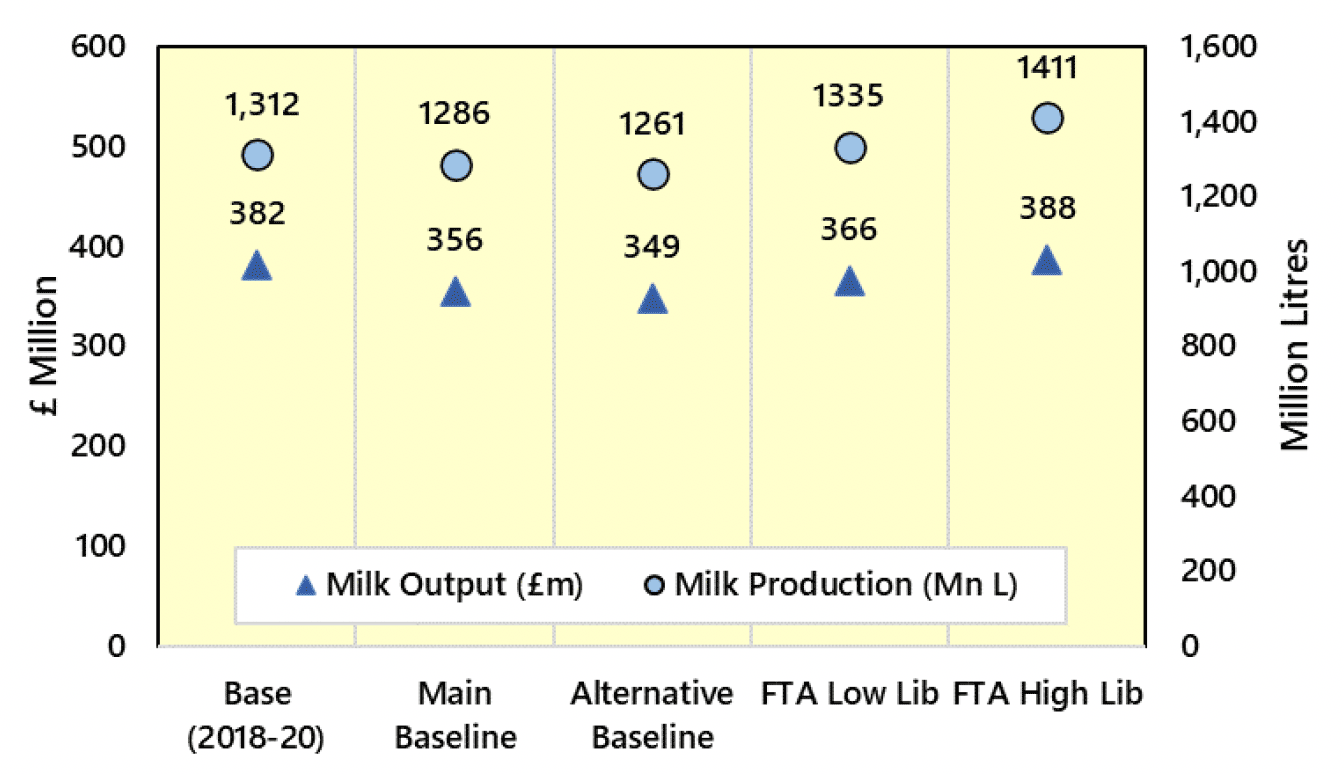

8.3.2 Dairy

Figure 8‑3 summarises the estimates of future Scottish milk production, in both value and volume terms, under the Main and Alternative Baselines as well as the FTA liberalisation scenarios.

Under both the Main and Alternative Baselines, output declines vis-à-vis the 2018-20 Base. However, the decline is more pronounced in the Alternative Baseline. This reflects the projection that increased trade barriers on dairy product imports into the UK from the EU will help the competitive position of UK producers which had been eroded in recent decades when the UK was an EU Member State. This finding is similar to previous studies which did project slight increases in Scottish dairy output due to Brexit15.

The introduction of FTAs are, on aggregate, anticipated to drive an increase in milk output. In volume terms, Scottish milk production is projected to surpass 1.4 billion litres under the High Liberalisation scenario and the value of output (£388 million) will also be slightly higher (by 1.6%) than the Base. The analysis indicates that the opportunities arising from FTAs, particularly with the GCC, will eclipse the competitive threat that some believe will be posed by NZ. That said, the ability of the Scottish dairy sector to realise these gains will be predicated on processors' ability to add value to Scottish milk produce. This is because, according to industry participants, many of the opportunities in the GCC region are centred on high value dairy products such as speciality cheese and yoghurt.

Sources: The Andersons Centre and Wageningen University and Research (WUR)

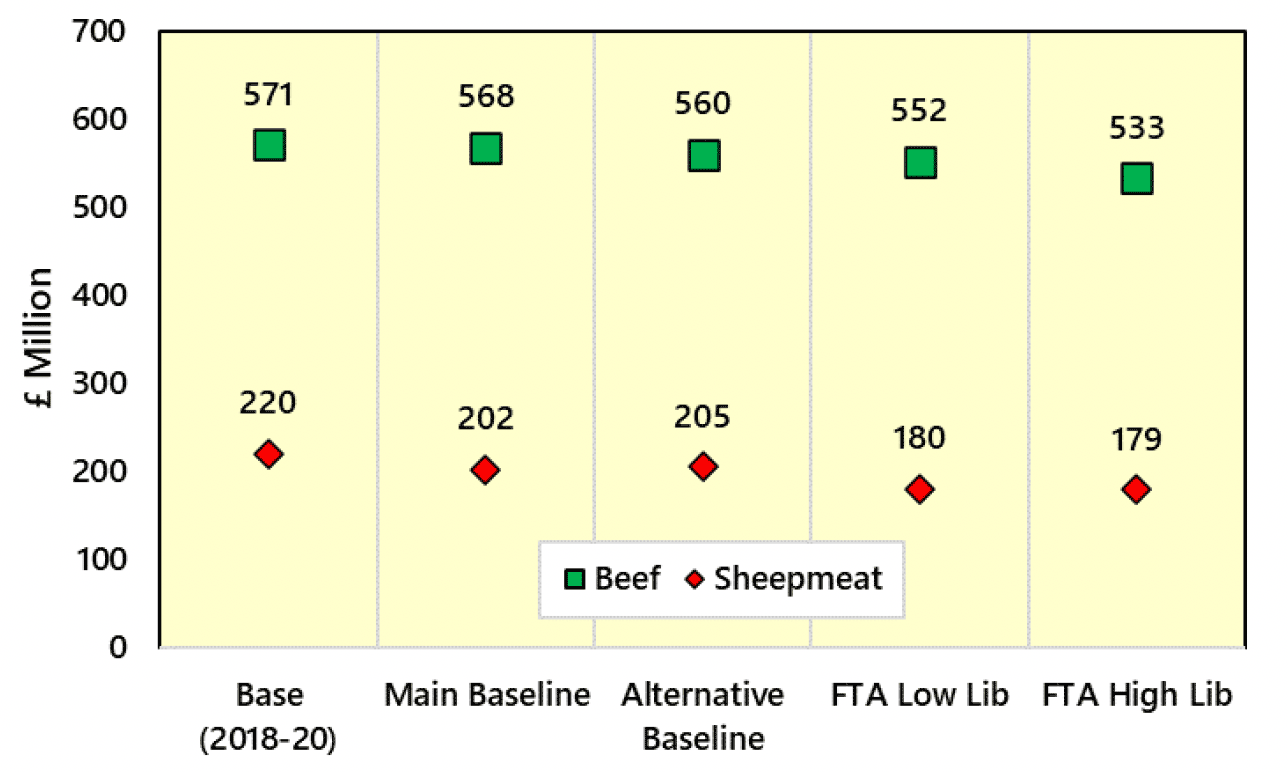

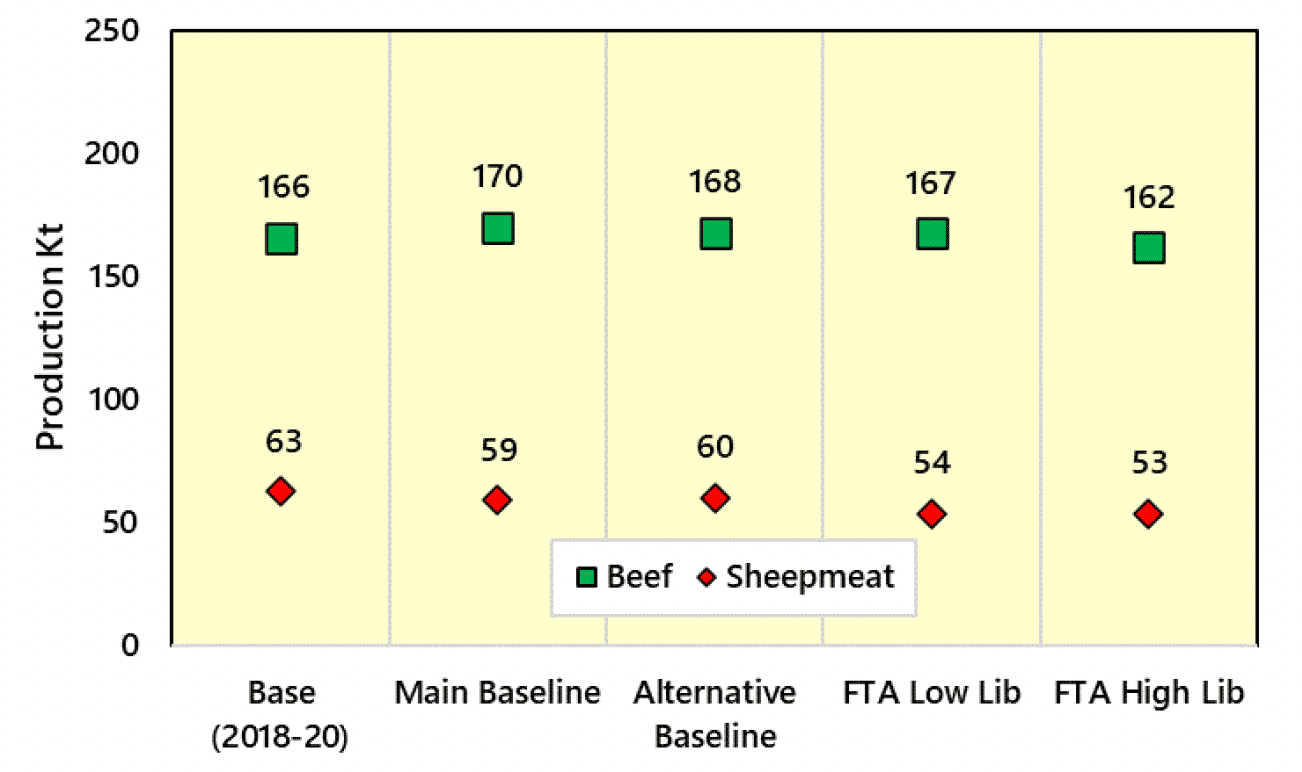

8.3.3 Grazing Livestock

The long-term projections of Scottish beef and sheepmeat output are set-out in Figure 8‑4, whilst Figure 8‑5 depicts estimated future production in tonnage terms. Under both the Main and Alternative Baselines, the value of beef output is projected to fall by between £8-11 million vis-à-vis the 2018-20 Base. The corresponding value of sheepmeat output is forecast to fall by £15-18 million in the long-term. In contrast to beef, sheepmeat output is slightly higher in the Alternative Baseline versus the Main Baseline. This illustrates the importance of sheepmeat exports to the EU and unhindered access to the Single Market.

In volume terms, Figure 8‑5 forecasts that beef production will increase by 2.6% in the Main Baseline. This again suggests that NTMs on imports into the UK from the EU, especially from Ireland, will help the competitive position of Scottish produce. Particularly as Main Baseline production is slightly higher than the Alternative Baseline.

Sheepmeat production also witnesses production declines, by around 5% to 6%, in the Main and Alternative Baselines. The fall is slightly less pronounced in the Alternative Baseline as access to the EU Single Market helps Scottish exports.

Sources: The Andersons Centre and Wageningen University and Research (WUR)

Sources: The Andersons Centre and Wageningen University and Research (WUR)

8.4 Farm-Level Implications

This section combines outputs from the MAGNET modelling results on projected prices with the primary research input as well as insights from previous studies and additional MS Excel-based analysis for potatoes. The farm-level assessments have been undertaken using information obtained from the Scottish Farm Business Income (FBI) annual estimates for 2019/20[26] (Base Year). This has been done via a static subtraction from the FBI results and compares the Main Baseline and FTA scenarios to the Base Year. Importantly, the production-related impacts of the FTAs have not been modelled at the farm-level.

8.4.1 Cereals Farming

Relative to other sectors, the projected impact on output prices on Scottish cereal farms arising from Brexit, other non-Brexit factors, and the application of non-EU FTAs is relatively low. A long-term 2.6% decline in cereals output is projected in the Main Baseline. As highlighted previously, this decline is due to a variety of factors including long-term trends in agricultural commodity prices and the relative competitiveness of UK agriculture. These trends were occurring before Brexit. As evidenced by the relatively small differences between output in the Main Baseline and No-Brexit scenario presented in the previous section, Brexit is not the central factor in these output declines.

The increased competitive pressures arising from the new non-EU FTAs, particularly Canada, indicates that prices would decline further, by 3.3% to 3.8% under the Low and High Liberalisation scenarios respectively, versus 2019/20. The results, therefore, suggest that the application of these new FTAs will lead to some additional declines in cereals output.

Costs are also projected to rise over the long-term in the Main Baseline – fertiliser costs are forecast to increase by 8.1%, with crop protection prices rising by around 1%. The application of the non-EU FTAs is not anticipated to lead to any significant changes for fertiliser and crop protection costs. However, seed costs are forecast to decrease as greater trade liberalisation means that the UK will be able to source more cheaply from non-EU sources and with less friction.

Taking the output and cost effects together, crops-specific gross margins are expected to decline by 6.6% under the Main Baseline (versus 2019/20). The declines are forecast to be more pronounced under the Low (-7.5%) and High Liberalisation (-8.1%) scenarios.

A similar picture also emerges when total agricultural output and variable costs are considered across Scottish cereals farms, i.e. when livestock enterprises within Scottish cereals farms are considered. Fixed costs are projected to rise by 0.4% across each scenario and this chiefly reflects the ending of Free Movement and associated labour cost increases (estimated at 7.5% for full-time labour (and 15% for casual labour)). Labour costs are projected to increase slightly in the FTA scenarios.

In 2019/20, Scottish cereals farms were, on average, already making losses, of nearly £3,000, from their agricultural activities. Given the fall in the monetary value of outputs and cost rises, it is unsurprising that the margin from agricultural production declines further under each scenario. Losses in the region of £10,300 to £11,800 are forecast.

In Table 8‑2, agricultural support has been maintained at 2019/20 levels for each scenario. This is crucial to cereals farms being able to generate a positive surplus during each of the comparison scenarios.

Despite this, agricultural business surplus declines by nearly 23% in the Main Baseline scenario and by around 25% to over 27% in the FTA Liberalisation scenarios. This suggests that the long-term future profitability of Scottish cereals farms will be even more heavily reliant on agricultural support.

| 19/20 (Base) | Main Baseline | FTAs (Low Lib) | FTAs (High Lib) | ||||

|---|---|---|---|---|---|---|---|

| Parameter | £ | £ | % Ch | £ | % Ch | £ | % Ch |

| Crops Output (excluding support) | 159,517 | 155,318 | -2.6% | 154,296 | -3.3% | 153,489 | -3.8% |

| Crops-Specific Variable Costs | 63,517 | 65,675 | 3.4% | 65,467 | 3.1% | 65,251 | 2.7% |

| Crops-Specific Gross Margin | 96,000 | 89,643 | -6.6% | 88,830 | -7.5% | 88,238 | -8.1% |

| Total Agricultural Output* | 190,524 | 185,787 | -2.5% | 184,740 | -3.0% | 183,905 | -3.5% |

| Total Agricultural Variable Costs* | 71,996 | 74,094 | 2.9% | 73,879 | 2.6% | 73,657 | 2.3% |

| Total Agricultural Fixed Costs* | 121,516 | 121,998 | 0.4% | 122,016 | 0.4% | 122,052 | 0.4% |

| Total Agricultural Costs | 193,512 | 196,092 | 1.3% | 195,895 | 1.2% | 195,709 | 1.1% |

| Agricultural Production Margin | -2,988 | -10,305 | -244.9% | -11,155 | -273.4% | -11,804 | -295.1% |

| Agricultural Support | 35,098 | 35,098 | 0.0% | 35,098 | 0.0% | 35,098 | 0.0% |

| Agricultural Business Surplus | 32,110 | 24,793 | -22.8% | 23,943 | -25.4% | 23,294 | -27.5% |

| Sources: Scottish Government (Scottish Farm Business Income (FBI) Publication), Andersons and WUR | |||||||

Note: *Includes both cereals and other farming enterprises (e.g. livestock) on Scottish cereals farms.

8.4.2 Dairy Farming

Table 8‑3 summarises the projected long-term farm-level impacts of the non-EU FTAs on Scottish dairy farming, again using averaged data on dairying for 2019/20 from the Scottish FBI publication. Milk output has been separated out from other livestock output (which is dominated by cattle).

As emphasised above, the Main Baseline incorporates both Brexit and non-Brexit effects. Again, based on the findings presented previously (see section 8.3.2), most of the decline in dairy output from 2019 to 2037 is due to factors unrelated to Brexit. That said, the imposition of trade barriers on UK-EU trade erodes the competitiveness of dairy goods imported from the EU and as Table 6‑4 shows, thus improving the relative competitiveness of UK and Scottish dairy output.

The analysis forecasts that long-term milk prices under the Main Baseline will drop by 5.7% versus the base year. Given the long-term nature of these projections and the relatively high milk prices in recent years coupled with frequent volatility in milk prices, it is unsurprising that long-term average prices are somewhat lower. When assessing the impacts of the FTAs, changes have only been made to selected output prices (e.g. milk, livestock and crops) and input cost parameters (e.g. fertiliser, animal feed, casual labour and other labour) which have been modelled using MAGNET. Other parameters such as support levels have been kept the same as the 2019/20 base year.

In addition to milk prices, cattle output prices are also projected to fall by 4.1% in the Main Baseline. This means that livestock output is forecast to decline by 5.5% on average.

Livestock output remains broadly the same under both FTA scenarios vis-à-vis the Main Baseline. The greater market access for UK dairy exports to markets such as the GCC means that the milk price decline (-5.5%) is not as pronounced in the High Liberalisation scenario. However, other livestock output declines further in the High Liberalisation scenario due to greater import competition from the likes of Australia and NZ.

A slight decline in livestock-specific variable costs is projected in the Main Baseline, driven chiefly by small reductions in feed and fodder prices. These declines remain largely the same in both FTA scenarios.

This means that, in the long-term, livestock gross margins on Scottish dairy farms are projected to decline by 11.9% vis-à-vis 2019/20 in the Main Baseline. However, the deteriorations are not as pronounced under the FTA scenarios, indicating that the new FTAs will, on aggregate, have a somewhat positive impact on dairy farming.

Fixed costs are anticipated to rise by 1.1% in the Main Baseline scenario. Here, the 7.5% increase in labour costs arising from the ending of Free Movement is significant. As with cereals, there is a very slight increase in labour costs in the FTA scenarios. Electricity costs are also projected to rise by 4% in the Main Baseline scenario although no additional changes are projected as a result of the non-EU FTAs.

This means that there is nearly a £36,000 swing in the margin from agricultural production on average on Scottish dairy farms in the long-term under the Main Baseline – the positive production margin of just over £22,800 becomes a loss to the tune of over £13,100. As with milk prices, the situation is only alleviated slightly in the FTA scenarios.

Holding support constant, agricultural business surplus is projected to decline by 58% to 60% in the long-term. Again, this illustrates the importance of support to Scottish dairy farm incomes, especially when milk prices decline.

| Parameter | 19/20 (Base) | Main Baseline | % Ch. vs Base | FTAs (Low Lib) | % Ch. vs Base | FTAs (High Lib) | % Ch. vs Base |

|---|---|---|---|---|---|---|---|

| Milk Output (excluding support) | 526,757 | 496,731 | -5.7% | 496,731 | -5.7% | 497,625 | -5.5% |

| Other Livestock Output (excl. support) | 71,108 | 68,188 | -4.1% | 68,200 | -4.1% | 68,082 | -4.3% |

| Total Livestock Output (excl. support) | 597,864 | 564,919 | -5.5% | 564,931 | -5.5% | 565,708 | -5.4% |

| Livestock-Specific Variable Costs | 293,520 | 291,230 | -0.8% | 290,999 | -0.9% | 290,757 | -0.9% |

| Livestock-Specific Gross Margin | 233,237 | 205,501 | -11.9% | 205,732 | -11.8% | 206,868 | -11.3% |

| Total Agricultural Output | 620,628 | 587,438 | -5.3% | 587,390 | -5.4% | 588,059 | -5.2% |

| Total Agricultural Variable Costs | 330,168 | 329,966 | -0.1% | 329,644 | -0.2% | 329,301 | -0.3% |

| Total Agricultural Fixed Costs | 267,653 | 270,580 | 1.1% | 270,609 | 1.1% | 270,647 | 1.1% |

| Total Agricultural Costs | 597,821 | 600,546 | 0.5% | 600,253 | 0.4% | 599,948 | 0.4% |

| Margin from Agricultural Production | 22,807 | -13,108 | -157.5% | -12,863 | -156.4% | -11,889 | -152.1% |

| Agricultural Support | 36,699 | 36,699 | 0.0% | 36,699 | 0.0% | 36,699 | 0.0% |

| Agricultural Business Surplus | 59,506 | 23,591 | -60.4% | 23,836 | -59.9% | 24,810 | -58.3% |

Sources: Scottish Government (Scottish Farm Business Income (FBI) Publication), Andersons and WUR

8.4.3 Grazing Livestock

The Scottish Farm Business Income data is segmented for cattle and sheep farms based on whether farms are categorised as Less-Favoured Area (LFA) or Lowland enterprises. The sections below summarise the "before" and "after" results for both types of farm respectively. The long-term projections, taken to occur 15 years after the non-EU FTAs are applied, simply look at the percentage changes vis-à-vis the Base year (2019/20) for each scenario.

LFA Cattle and Sheep Farms

Table 8‑4 summarises the projected long-term farm-level impacts of each FTA scenario for Scottish LFA Beef and Sheep farms. Based on the June 2021 Agricultural Census, it is estimated that there are around 14,850 LFA cattle and sheep holdings in Scotland, over five times the number of lowland cattle and sheep farm holdings (2,700)[27]. The focus is on cattle and sheep farming as well as associated agricultural activities (e.g. ancillary cereals enterprises). In terms of total agricultural output, sheep accounts for the majority (51%) with cattle enterprises accounting for 40%. The remaining 9% is allocated to a range of other small-scale enterprises.

Under both FTA scenarios, livestock output declines by 4.2% to 4.4%. However, the MAGNET modelling indicates that most of this decline (3.8%) occurs in the Main Baseline. Given the size of the sheep enterprise, the sheep price decline of 3.6% is heavily influential, as is the 4.1% decline in beef cattle prices. The application of non-EU FTAs result in further prices declines for sheep. This means that sheep prices are 4.3% to 4.5% lower than the Base Year under the Low and High Liberalisation scenarios respectively. Here, the increased competition brought about by imports from NZ and Australia is the major factor. In contrast, the additional price declines for cattle under each FTA scenario are minimal (i.e., less than 0.2% difference versus the Main Baseline).

Livestock-specific variable costs are not projected to change significantly over the long-term based on the MAGNET modelling. In the Main Baseline, some rises are projected for veterinary and medicines (+5.7%) as the ending of Free Movement has affected the availability of veterinarians and costs have risen accordingly. However, this is offset by declines of around 1.5% in animal feed and fodder costs. Minimal change is also forecast under the other FTA scenarios.

Taking account of the output price declines and the minimal variable cost changes, the livestock specific gross margins are forecast to fall by 7.8% in the Main Baseline, with slightly more pronounced declines of 8.5% to 8.9% under the Low and High Liberalisation scenarios. These estimates represent sizeable falls in profitability. Here, the influence of Brexit is of significance, particularly in terms of prices (as alluded to in Table 8‑1 above).

Of course, for the purpose of this analysis, the number of livestock on-farm has been kept constant. If the output declines projected in Chapter 6 were also factored in, the profitability of LFA cattle and sheep farms would be eroded further.

When the impacts on other agricultural enterprises and fixed costs are considered, the agricultural production margin experiences further declines of approximately 11% to 12%. This means that LFA cattle and sheep farms would make average losses in excess of £40,000 under each scenario.

Once again, support payments are pivotal to these farms generating business surpluses. However, the average agricultural business surplus is projected to decline by 16.7% in the Main Baseline. The declines are more pronounced in the FTA scenarios, ranging from 17.7% to over 18%.

These projections suggest that there will not be much scope for reinvestment in cattle and sheep enterprises for the long-term. This will limit the sector's attractiveness to young farmers and new entrants. As highlighted in the industry interviews, this presents serious challenges for the future viability of many cattle and sheep farms in Scotland.

| Parameter | 19/20 (Base) | Main Baseline (Brexit) | % Ch. vs Base | FTAs (Low Lib) | % Ch. vs Base | FTAs (High Lib) | % Ch. vs Base |

|---|---|---|---|---|---|---|---|

| Livestock Output (excluding support) | 74,930 | 72,082 | -3.8% | 71,791 | -4.2% | 71,622 | -4.4% |

| Livestock-Specific Variable Costs | 38,281 | 38,285 | 0.0% | 38,263 | 0.0% | 38,241 | -0.1% |

| Livestock-Specific Gross Margin | 36,648 | 33,798 | -7.8% | 33,528 | -8.5% | 33,381 | -8.9% |

| Total Agricultural Output | 82,298 | 79,380 | -3.5% | 79,079 | -3.9% | 78,906 | -4.1% |

| Total Agricultural Variable Costs | 48,238 | 48,748 | 1.1% | 48,684 | 0.9% | 48,616 | 0.8% |

| Total Agricultural Fixed Costs | 70,632 | 71,134 | 0.7% | 71,139 | 0.7% | 71,145 | 0.7% |

| Total Agricultural Costs | 118,870 | 119,881 | 0.9% | 119,823 | 0.8% | 119,761 | 0.7% |

| Margin from Agricultural Production | -36,572 | -40,502 | -10.7% | -40,744 | -11.4% | -40,855 | -11.7% |

| Agricultural Support | 60,107 | 60,107 | 0.0% | 60,107 | 0.0% | 60,107 | 0.0% |

| Agricultural Business Surplus | 23,536 | 19,606 | -16.7% | 19,363 | -17.7% | 19,252 | -18.2% |

Source: Scottish Farm Business Survey (2019/20)

Lowland Cattle and Sheep Farms

Similar to the analysis for LFA cattle and sheep, Table 8‑5 summarises the results of the long-term Main Baseline and the impact of the Low and High Liberalisation FTA scenarios on Scottish lowland cattle and sheep farms. Again, agricultural enterprises are the focus with contracting and diversification activities have been removed from the analysis.

The assumptions underpinning the projected percentage changes under all scenarios are the same as those presented previously for LFA farms. However, due to differences in enterprise mix and utilisation of resources, some differences emerge. On lowland farms, cattle production accounts for 61% of agricultural output. Sheep and wool has a relatively low (19%) share. Of the other enterprises, barley (9%) is the most prominent.

Given these differences in enterprise mix, specifically the smaller share of sheep, it is unsurprising that whilst all scenarios show declines in enterprise output, ranging from 4% to 4.3%, they are less pronounced than for LFA farms. Again, most of these declines are projected in the Main Baseline, with Brexit being of significance, but not the only influence.

Livestock-specific variable costs show small long-term decreases. This is chiefly driven by reduced animal feed costs (-1.5% to -1.7%) with these decreases again being partially offset by increased veterinary and medical costs.

The resultant livestock-specific gross margin declines by 7.6% in the Main Baseline with the impact being somewhat more pronounced in the FTA scenarios (-7.9% to -8.2%).

Similar to LFA farms, lowland cattle and sheep farms also makes a loss from agricultural production, estimated at nearly £24,900 in 2019/20. Given the impact on livestock gross margins, losses from agricultural production are projected to surpass £30,000 in the long-term under both the Main Baseline and FTA scenarios.

Concerningly, for these farms, the support payments (nearly £35,500) just about cover these projected long-term losses. The agricultural business surplus for lowland farms is forecast to at least halve in the future. Again, the viability of many lowland grazing livestock farms will be called into question, particularly if FTAs are also agreed with other major livestock producing countries, such as the US.

| Parameter | 19/20 (Base) | Main Baseline (Brexit) | % Ch. vs Base | FTAs (Low Lib) | % Ch. vs Base | FTAs (High Lib) | % Ch. vs Base |

|---|---|---|---|---|---|---|---|

| Livestock Output (excluding support) | 106,302 | 102,098 | -4.0% | 101,937 | -4.1% | 101,725 | -4.3% |

| Livestock-Specific Variable Costs | 55,486 | 55,150 | -0.6% | 55,110 | -0.7% | 55,069 | -0.8% |

| Livestock-Specific Gross Margin | 50,816 | 46,948 | -7.6% | 46,827 | -7.9% | 46,656 | -8.2% |

| Total Agricultural Output | 131,240 | 126,605 | -3.5% | 126,384 | -3.7% | 126,145 | -3.9% |

| Total Agricultural Variable Costs | 76,034 | 76,759 | 1.0% | 76,649 | 0.8% | 76,529 | 0.7% |

| Total Agricultural Fixed Costs | 80,078 | 80,514 | 0.5% | 80,519 | 0.6% | 80,524 | 0.6% |

| Total Agricultural Costs | 156,112 | 157,274 | 0.7% | 157,168 | 0.7% | 157,053 | 0.6% |

| Margin from Agricultural Production | -24,872 | -30,668 | -23.3% | -30,783 | -23.8% | -30,908 | -24.3% |

| Agricultural Support | 35,440 | 35,440 | 0.0% | 35,440 | 0.0% | 35,440 | 0.0% |

| Agricultural Business Surplus | 10,568 | 4,771 | -54.9% | 4,656 | -55.9% | 4,532 | -57.1% |

Source: Scottish Farm Business Survey (2019/20)

8.4.4 Potatoes

The MAGNET modelling did not cover potatoes. Given the importance of seed potatoes in Scotland, Table 8‑6 shows the projected impact of Brexit (reflected in the Main Baseline) and the FTA scenarios on a Scottish seed potatoes enterprise. In contrast to the MAGNET modelling results above, it has not been possible to model other long-term structural changes in the potatoes' sector that might arise due to population growth, GDP, cost competitiveness etc. Accordingly, changes in the Main Baseline versus the Base Year, summarised in Table 8‑6, are chiefly to do with Brexit.

The farm-level data shown in Table 8‑6 are primarily based on the Scottish Farm Management Handbook (2019/20)[28] for a high-performing seed potatoes' enterprise. Casual labour costs from the ABC Book (90th Edition)[29] are used as these are not reported in the Farm Management Handbook.

The analysis combines insights from previous studies which Andersons and WUR have been involved in as well as input from this study's primary research (see section 7.1.6) and the generic input cost data projected by MAGNET. The analysis focuses on assessing impact of each scenario on output, variable costs and gross margins, when casual labour is factored into consideration.

Based on primary research and desk-based input, it is estimated that seed potato prices are approximately 4% lower than they otherwise would have been had Brexit not occurred. This is driven by the loss of export sales to the EU27 market and NI (which is in the EU Single Market for goods). Together, these markets account for around 8% of Scottish seed potatoes' production (see Table 4‑4). The percentage fall in seed potatoes prices is estimated at around half of this share. Primary research input suggests that the impact on ware potatoes' prices have been relatively minimal, especially for Scotland.

As a result, output from Scottish seed potato farms is estimated to decline by 3.9% in the Main Baseline. Similar declines are projected in the FTA scenarios. Whilst interviewees acknowledge that some increased sales of seed potatoes to the GCC market could take place as a result of an FTA, it represents a small share of export sales, so any impacts on price would be minimal.

Using the input cost assumptions generated in each scenario by the MAGNET modelling, variable costs are forecast to rise by 1.4% in the Main Baseline. Whilst fertiliser prices are projected to increase by 8.1%, this is largely offset by the 4.1% decline in seed prices, as explained above. Crop protection costs are forecast to increase by 1.1% and casual labour costs by 15%. However, casual labour costs account for a relatively small proportion (14%) of the selected variable costs in the Main Baseline. For each of the FTA liberalisation scenarios, variable costs are projected to remain essentially the same.

Taking account of these changes, the gross margin on Scottish seed potato farms is projected to decline by around 64% to 65% in the future. There is relatively little difference in performance between the Main Baseline and the FTA scenarios, with casual labour costs rising slightly further under the FTAs based on MAGNET modelling projections for crop-related labour costs (see Table 9‑1). The new non-EU FTAs are not expected to have a significant impact on the Scottish seed potatoes' sector. It is clear that restoring access to EU and Northern Irish markets is the key to safeguarding the long-term profitability of the Scottish seed potatoes sector.

| Parameter | 19/20 (Base) | Main Baseline (Brexit) | FTAs (Low Lib) | FTAs (High Lib) | |||

|---|---|---|---|---|---|---|---|

| £/Ha | £/Ha | % Ch. | £/Ha | % Ch. | £/Ha | % Ch. | |

| Seed (25t/ha; £220/t) | 6,650 | 6,379 | -4.1% | 6,382 | -4.0% | 6,385 | -4.0% |

| Ware (6t/ha; £45/t | 270 | 270 | -0.1% | 270 | 0.0% | 270 | 0.0% |

| Stockfeed (2t/ha; £20/t) | 40 | 40 | 0.0% | 40 | 0.0% | 40 | 0.0% |

| Output | 6,960 | 6,689 | -3.9% | 6,692 | -3.9% | 6,695 | -3.8% |

| Total Variable Costs | 6,410 | 6,495 | 1.3% | 6,497 | 1.4% | 6,502 | 1.4% |

| Gross Margin | 551 | 194 | -64.7% | 194 | -64.7% | 192 | -65.0% |

Sources: Farm Management Handbook (2019/20), Agricultural Budgeting and Costing Book, Andersons

Variable costs are primarily based on Scottish Farm Management Handbook, but as these do not include casual labour, costings from the Agricultural Budgeting Costing Book (90th edition) have been used to provide indication of Brexit impact.

8.5 Concluding Remarks

The analysis presented in this Chapter shows that the introduction of new FTAs with non-EU partners will generally have limited impacts on Scottish farm-level performance in the long-term. Instead, and as illustrated in sections 8.3 and 8.4, it is the projected changes expected to occur in the Main Baseline scenario, which are mostly due to non-Brexit factors, that will contribute most to the declines in farm business income. That said, it remains crucial for Scottish farm sectors to continue to have good market access to the EU and that the recently lost access for seed potatoes is restored.

It is also clear that without continued support and, if long-term price trends continue, many farm businesses will experience severe financial pressure, particularly on cattle and sheep farms. This will have significant implications for the future viability and structure of the industry as well as for the Scottish rural economy more generally.

Contact

Email: frederick.foxton@gov.scot

There is a problem

Thanks for your feedback