Agricultural food and drink sector - impact of future UK Free Trade Agreement scenarios: research

This research assesses the impacts of future Free Trade Agreements (FTAs) between the UK and four selected non-EU trading partners on key Scottish agricultural sectors. The work combines trade-model and farm-level analysis, supplemented by industry interviews and desk-based research.

9. Key Conclusions and Final Remarks

This study shows that the potential impacts of future non-EU FTAs on Scottish farming are complex and require a nuanced analysis, particularly with Brexit having already taken place.

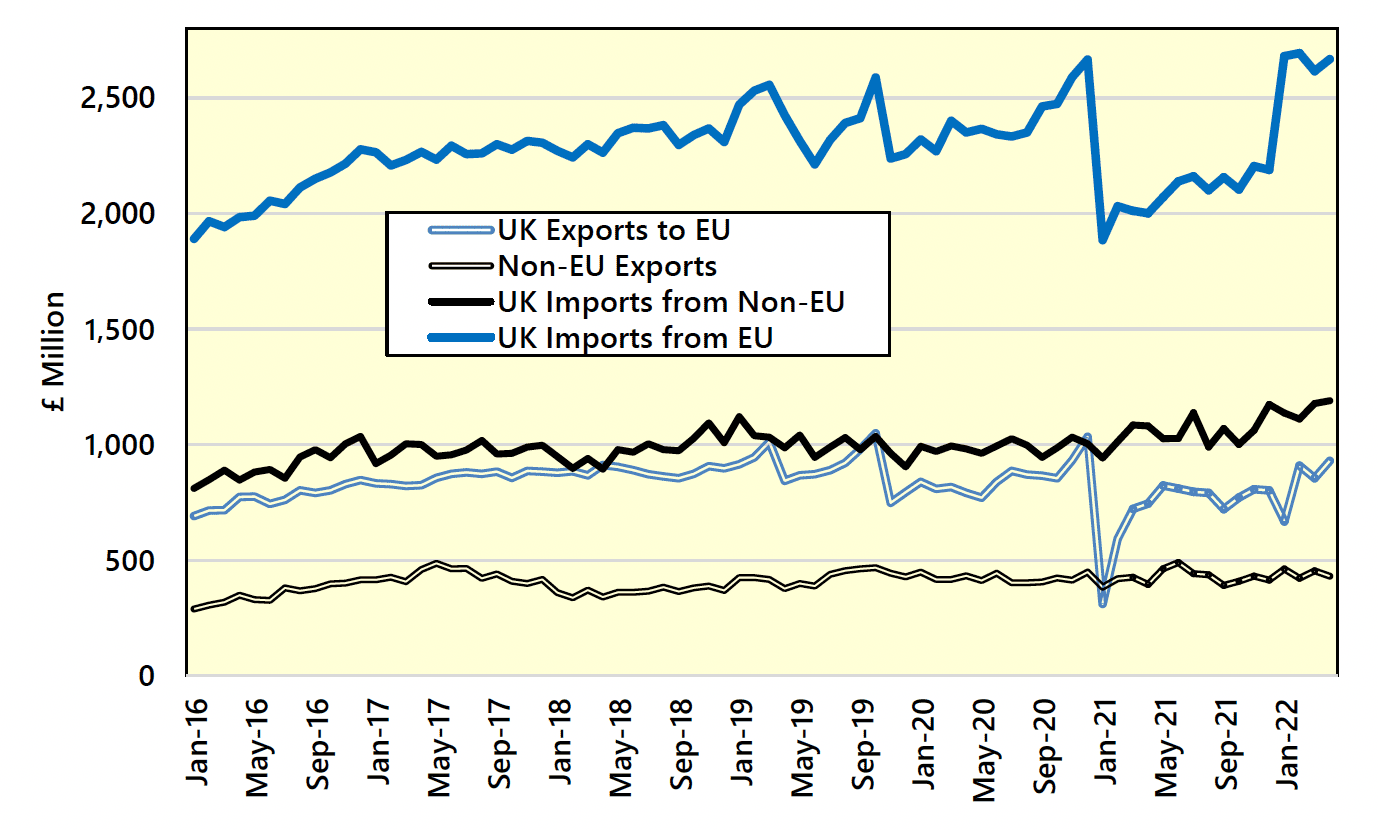

Whilst the UK-EU TCA provides for tariff-free and quota-free trade between the UK and the EU27, as Figure 9‑1 shows, the imposition of NTMs had a substantial impact on trade between both parties during 2021. Whilst trade with the EU has recovered strongly since, it is also evident that UK trade with non-EU partners, specifically imports is also increasing. As results from this study show, the reorientation of trade towards non-EU countries will become more pronounced as the UK agrees trade-deals with non-EU countries. With this in mind, the study's key conclusions are set-out below.

Source: ONS

9.1 Key Conclusions

1. Impact of selected FTAs is generally limited, but significant in some sectors: similar to other studies looking at the impact of FTAs with non-EU partners on UK agri-food, the long-term impact of the trade deals assessed in this study is generally relatively limited. Even though MAGNET CGE model would predict in some cases more substantial increase in trade volumes, projected impacts on value added are less pronounced. The complementary qualitative analysis (Primary Research) also presents a similar perspective. That said, the impact on Scottish sheepmeat output is forecast to be significant and is of concern to industry participants. Beef and wheat output are also negatively affected, but to a lesser extent.

2. Non-EU FTAs lead to contrasting projections for wheat and barley: at the UK level, the new FTAs are projected to bring about a GVA decline of wheat by 2.7% to 5.9% under Low and High Liberalisation scenarios respectively vis-à-vis the Main Baseline. However, barley GVA is forecast to rise slightly by 0.2% to 0.3%. That said, there is the potential for a higher GVA to be achieved for the Scottish economy, via increased whisky exports to overseas markets as a result of new FTAs.

3. Biggest FTA opportunities for the dairy sector: of the commodities assessed, the dairy sector is best positioned to see export growth. Here, the GCC market is viewed as offering notable growth potential. Whilst opportunities also exist to export to Canada, as this market is highly protectionist, such opportunities are likely to be limited to selected niches (e.g. high-end cheeses).

4. Scottish sheepmeat is going to come under the most pressure: arising from the non-EU FTAs. Whilst NZ has only been partially fulfilling its TRQ in recent years, the introduction of the new FTA is seen by many industry participants as a strong signal for NZ businesses to recapture trade with the UK, which was lost when the UK joined the EEC. Given the provisions of the UK-NZ FTA, it is likely that in the coming years, the increased imports from NZ will be catered for via the pre-existing WTO TRQ. However, if geopolitics changes the trading relationships between Australia, NZ and China, it is likely that additional volumes of antipodean sheepmeat will be exported to the UK.

5. Beef sector will come under notable pressure but some opportunities also exist: whilst imports from Australia and NZ will exert significant pressure, a trade deal with Canada is likely to generate some export opportunities. Given the brand recognition of Scotch beef, it should be relatively well-positioned to exploit such niches. That said, safeguarding domestic sales, particularly to UK retailers, from overseas competitors will remain most crucial.

6. Cumulative impacts of future FTAs will be more significant: although the aggregated impact of the selected FTAs is relatively limited, the cumulative effect of multiple trade deals over the longer term should not be underestimated. This is especially so if the UK agrees FTAs with agricultural powerhouses such as the US and Mercosur (including Brazil and Argentina).

7. The FTAs with Australia and NZ set important precedents: the recently agreed FTAs with Australia and NZ give important signals to trade negotiators elsewhere as to what the UK is willing to cede in trade negotiations. Therefore, the standards that the UK is willing to accept for imports is pivotal, especially as other FTA partners will likely push for more concessions during negotiations. Any significant changes to standards relating to food safety and hygiene, the environment and animal welfare will have major implications for Scottish produce. This is not just on the home market, but overseas as well, especially in terms of highly-renowned brands such as Scotch Beef.

8. Impact of selected FTAs on wages is projected to be minimal: similar to other studies looking at the impact of FTAs with Australia and NZ on the wider economy, the MAGNET modelling results suggest that the impact of the selected FTAs on wages within the selected agri-food sectors is projected to be minimal versus the Main Baseline (see Table 9‑1). Even in the High Liberalisation scenario, wages are projected to be just 0.8% higher for cereals and 0.2% higher for dairy and red meat. Of more significance, was the ending of Free Movement in January 2021, which contributed to significant increases in labour costs and the ability of the agri-food industry to access the labour supply that it needs. Within the sectors selected, this impact is most apparent in meat processing; however, it is in the horticulture sector (not within scope) where the challenges are most pronounced.

9. Effects of FTAs on employment will be closely aligned to GVA impacts by sector: Table 9‑1 also shows that employment in the sheepmeat sector will be most negatively affected by the selected FTAs with declines of around 10.5% to just over 11% projected. Notable declines are also forecast for wheat and beef and are estimated at 3% and 6% for the Low and High Liberalisation scenarios respectively. Conversely, dairy sector employment could increase by 9% in the High Liberalisation scenario. Whilst the results suggest that there would be minimal change to employment linked with barley processing, there is evidence that increased demand for Scotch whisky is driving increased employment by Scottish maltsters. In turn, if the new FTAs drive significant increases in whisky exports, then it is likely that long-term employment in barley malting operations will be higher than the results in Table 9‑1 suggest.

| Impact on Wages | Impact on Employment | |||

|---|---|---|---|---|

| Sector | FTA Low Liberalisation | FTA High Liberalisation | FTA Low Liberalisation | FTA High Liberalisation |

| Wheat | 0.3% | 0.8% | -2.9% | -6.3% |

| Barley | 0.3% | 0.8% | 0.2% | 0.1% |

| Dairy | 0.1% | 0.2% | 3.0% | 9.0% |

| Beef | 0.1% | 0.2% | -2.8% | -6.1% |

| Sheepmeat | 0.1% | 0.2% | -10.5% | -11.1% |

Sources: Wageningen University and Research (WUR) and Andersons

10. Long-term impact of Brexit is also deemed to be limited: this study shows relatively small differences in output under the Main Baseline (incorporating Brexit) and the Alternative Baseline (No-Brexit scenario). That said, the loss of the EU and NI markets for Scottish seed potato exports is significant and the restoration of this market access is a key goal for the sector. It should also be a primary objective for policy-makers.

11. Short-term impacts of Brexit are more pronounced on UK exports to the EU: in comparison with imports in the opposite direction. This is because the UK Border Operating Model for controlling imports will not become fully functional until the end of 2023. Conversely, UK exports to the EU have been subject to border controls and checks since January 2021. Furthermore, the impact of regulatory controls on UK-EU trade has had a more substantial impact on small and micro enterprises. In numerous cases, these businesses have ceased trading with the EU. Therefore, whilst overall trade might not be that affected, this trade is now in the hands of larger traders to a much greater extent.

12. Whilst Covid-19 had substantial impacts during 2020 and 2021, the long-term effects are deemed to be limited: undoubtedly, the Covid-19 pandemic has had a major impact on the global economy, particularly during 2020 and 2021. However, despite this, its effect on agri-food was relatively limited[30]. The biggest effects on agri-food were in terms of labour availability and costs as well as the associated supply-chain and logistical challenges. Whilst this was a key factor in the sizeable wage increases for logistics staff and HGV drivers and has contributed to increased global inflation, by the time that the industry interviews were being undertaken in this study, the focus has started to shift away from the pandemic. Although labour costs and supply-chain issues which have arisen from Covid-19 are anticipated to linger for a few months yet, they are not expected to have a major long-term impact. Indeed, most industry participants believe that the Russia-Ukraine conflict will have a more telling impact on the future performance of the global agri-food industry.

13. Land-use change pressures will also be highly influential: industry feedback suggests that whilst trade-related pressures will be significant for grazing livestock, other long-term pressures will also feature prominently. In particular, the pressure (incentive) for land-use change arising from poor profitability in grazing livestock as well as societal needs to offset greenhouse gas emissions will heavily influence the future size and structure of the industry. This is especially so in Scotland where tree-planting has already led to declines in sheep populations. This trend is expected to continue.

14. Scottish agricultural produce is highly valued internationally and its reputation needs to be leveraged further: industry interviewees highlight the importance of exploiting the brand reputation of Scotch beef, whisky and salmon in overseas markets. This strong reputation needs to be leveraged into other sectors, particularly lamb and dairy products.

9.2 Final Remarks

Overall, it is evident that the UK and Scottish farming industries have entered a "Decade of Disruption". Aside from the new FTAs, the industry is grappling with multiple challenges arising from inflation, policy reform, structural challenges, labour shortages, and GHG emissions. Whilst the onus is ultimately on the Scottish food and farming industries to adapt to such pressures, it is incumbent on policy-makers to support where possible. This is especially the case in terms of managing the transition that is ahead.

By getting the balance right, policy-makers can support Scottish food and farming in becoming a more market oriented, competitive and sustainable industry in the long-term. Environmental concerns have become a central consumer issue both domestically and overseas. There should be a focus on creating a compelling value proposition for Scottish agri-food produce that is high-quality and "Eco-friendly". Indeed, the development of an "Eco" brand that encapsulates the high-quality, integrity and sustainability of Scottish produce should be pursued further. This would help to safeguard the position of Scottish produce domestically and serve as a flagship to capture overseas sales.

This will require collaboration, not just within a UK context, but with likeminded overseas partners as well. Globally, the agricultural sector has more to gain by working together to address and overcome major societal challenges (e.g. climate change, biodiversity crisis, feeding a planet of 9-10 billion people).

Change has always been a feature of farming and the industry has come through multiple crises in the past. The Covid-19 pandemic, Brexit and the Russia-Ukraine war have created new challenges. But, these crises have also shown the importance of robust, secure and high-integrity supply-chains. Given the strong international reputation of Scottish food and drink, whilst the new FTAs will bring challenges, there are also opportunities, provided that there is a level playing field for all.

Contact

Email: frederick.foxton@gov.scot

There is a problem

Thanks for your feedback