Scottish Housing Market Review: Q2 2023

Quarterly bulletin collating a range of statistics on the Scottish housing market, such as house prices and transactions, rental trends, cost and availability of finance, etc.

This document is part of a collection

3. Residential Land Buildings Transaction Tax (LBTT)

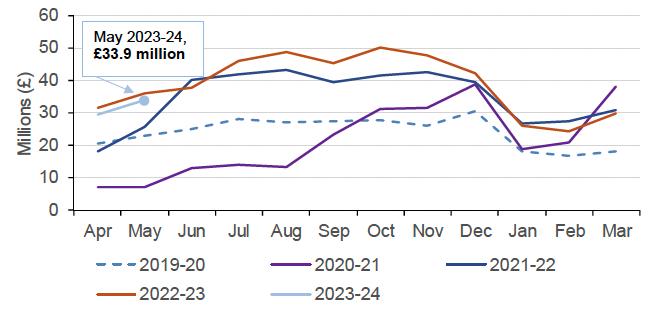

Residential Land and Buildings Transaction Tax (LBTT) revenue excluding the Additional Dwelling Supplement (ADS) rose sharply from £20.8m in February 2021 to £38.1m in March 2021, due to transactions being brought forward in response to the temporary increase of the zero rate threshold for all buyers to £250K, which took effect on 15 July 2020 and ended on 31 March 2021. Revenue then fell to £18.2m in April 2021, but as from May 2021 residential LBTT revenues picked up and remained elevated relative to previous years, with revenue for the 2021-22 financial year 45% higher than in 2019-20.

This trend continued during 2022-23, with revenue 12% higher than in 2021-22, and 62% higher than 2019-20, prior to Covid-19, with higher house prices (see Chart 2.1) a key factor in the increase in revenue. In the first two months of 2023-23, revenues have been below their level in the corresponding months of 2022-23, reflecting declining activity levels and the slowdown in house price inflation.

Source: Revenue Scotland

Contact

Email: jake.forsyth@gov.scot

There is a problem

Thanks for your feedback