Scottish Housing Market Review: Q2 2023

Quarterly bulletin collating a range of statistics on the Scottish housing market, such as house prices and transactions, rental trends, cost and availability of finance, etc.

This document is part of a collection

8. Mortgage Arrears & Possessions

Arrears

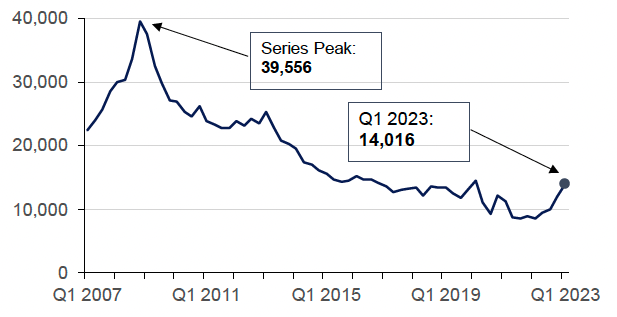

There were 14,016 regulated mortgages that went into arrears across the UK in Q1 2023, an annual increase of 63.1% (5,424), although this is from very low levels in Q1 2022. Comparing to the pre-pandemic period in Q1 2020, the number of regulated mortgages entering arrears has fallen by 3.1% (-446) As shown in Chart 8.1, following a peak of 39,556 in Q4 2008 during the financial crisis, there was a declining trend in arrears which continued during the Covid period; however, arrears have now started to increase towards pre-pandemic levels. It should be noted that Covid-19 payment holidays were not classified as technical arrears, and thus are not reflected in these figures; however, even when these payment holidays came to an end in April 2021, this did not result in a substantial increase in arrears. (Source: FCA)

Source: FCA

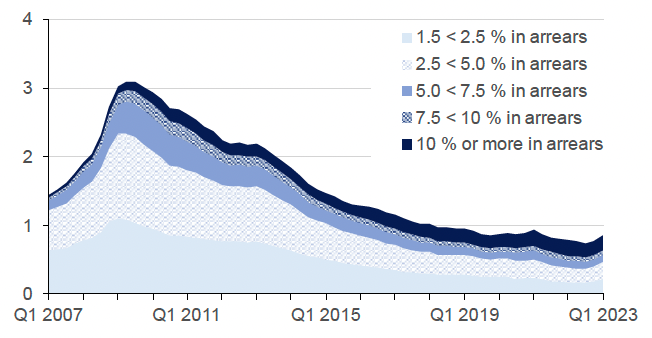

The share of lenders' outstanding regulated mortgage balances that were in arrears stood at 0.84% at the end of Q1 2023. This has remained broadly stable during the pandemic but did start to increase towards the end of 2022 and into 2023. Chart 8.2 plots the share of lenders' outstanding balances that were in arrears by degree of severity. Arrears reported in the FCA MLAR data relate only to loans where the amount of actual arrears is 1.5% or more of the borrower's current loan balance.

Source: FCA

UK Finance data show that there were 7,030 buy-to-let mortgages in arrears of 2.5% or more of the outstanding balance across the UK in Q1 2023. This is up by an annual 19.8% (1,160). The number of buy-to-let mortgages in arrears of 2.5% or more as a percentage of the total number of buy-to-let mortgages was 0.34% as at Q1 2023, slightly above Q1 2022 (0.29%).

Possessions

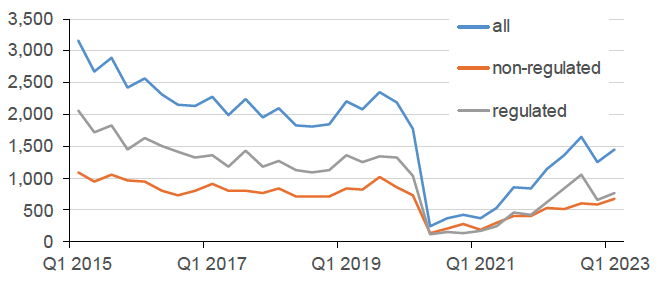

Chart 8.3 shows that despite restrictions on possessions being lifted since 1 April 2021, there were only 769 new regulated mortgage possessions across the UK in Q1 2023. While this was an increase relative to Q1 2022 of 150 (+24.2%), possessions are still substantially lower (down 273, or 26.2%) relative to Q1 2020, prior to the pandemic. (Source: FCA)

In June 2023, the Chancellor of the Exchequer met with the UK's principal mortgage lenders and the FCA, they agreed to a new mortgage charter which provides support to residential mortgage customers. The charter states that anyone can call their lender for information and support without any impact on their credit score. Residential mortgage customers who are up to date with payments can change to interest-only payments or extend the term of their mortgage and return to their original mortgage deal, within six months, with no impact on their credit score. The banks and mortgage lenders have also agreed there will be a minimum 12-month period before there is enforcement of repossession orders without consent.

Source: FCA

Contact

Email: jake.forsyth@gov.scot

There is a problem

Thanks for your feedback