Scottish Housing Market Review Q3 2023

Quarterly bulletin collating a range of previously published statistics on the latest trends in the Scottish housing market.

This document is part of a collection

3. Residential Land & Buildings Transaction Tax

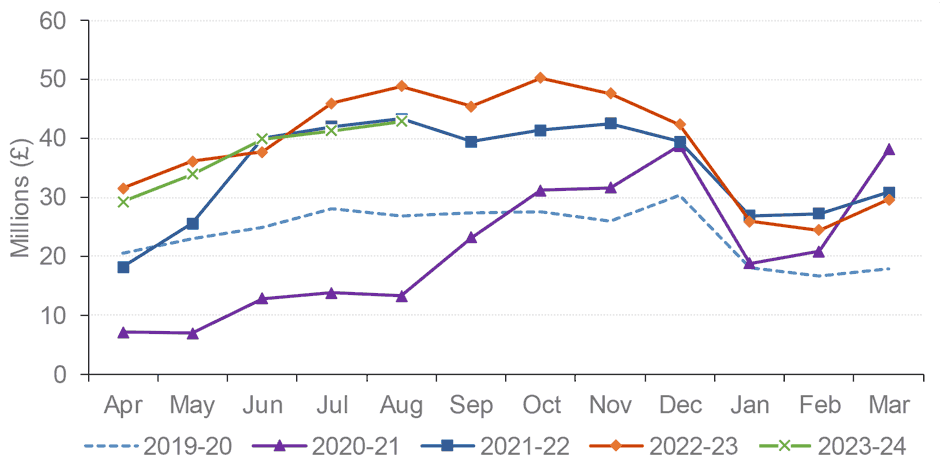

Residential Land and Buildings Transaction Tax (LBTT) revenue excluding the Additional Dwelling Supplement (ADS) fell sharply in the early months of 2020-21 due to the impact of Covid restrictions on residential transactions. However, since the latter half of 2020-21, revenues have generally been significantly above their pre-pandemic levels in 2019-20, boosted not only by the sharp rebound in transactions (see Chart 1.1) as Covid restrictions were lifted but also by significant house-price inflation (see Chart 2.1). As a result, revenue for the 2021-22 financial year was 45% higher than in 2019-20, while in 2022-23 revenue was 12% higher than in 2021-22 and 65% higher than 2019-20.

However, the latest data indicates a slowdown in revenue, with revenue for the first five months of 2023-24 6% less than the corresponding months of 2022-23, although it was 52% higher than the corresponding months of 2019-20, prior to the pandemic.

Source: Revenue Scotland

Contact

Email: Bruce.Teubes@gov.scot

There is a problem

Thanks for your feedback